Forex Hedging. Hedging in forex is the method of reducing your losses by opening one or more currency trades that offset an existing position. The two positions should be the same size in order to zero out your losses.

This is especially the case if you are a new trader or you simply want to take a step back. This is called forex hedging, and as you can see the gains from your second position will offset the expected losses from your first position. The foreign exchange markets can be affected by adverse conditions, such as changing interest rates or inflation, so traders aim to protect their open positions by bulling or selling additional assets to reduce the overall risk of exposure.

This can be usable for short time and also for long timeframe.

Hedging itself is the process of buying or selling financial instruments to offset or balance your current positions, and in doing so reduce the risk of your exposure.

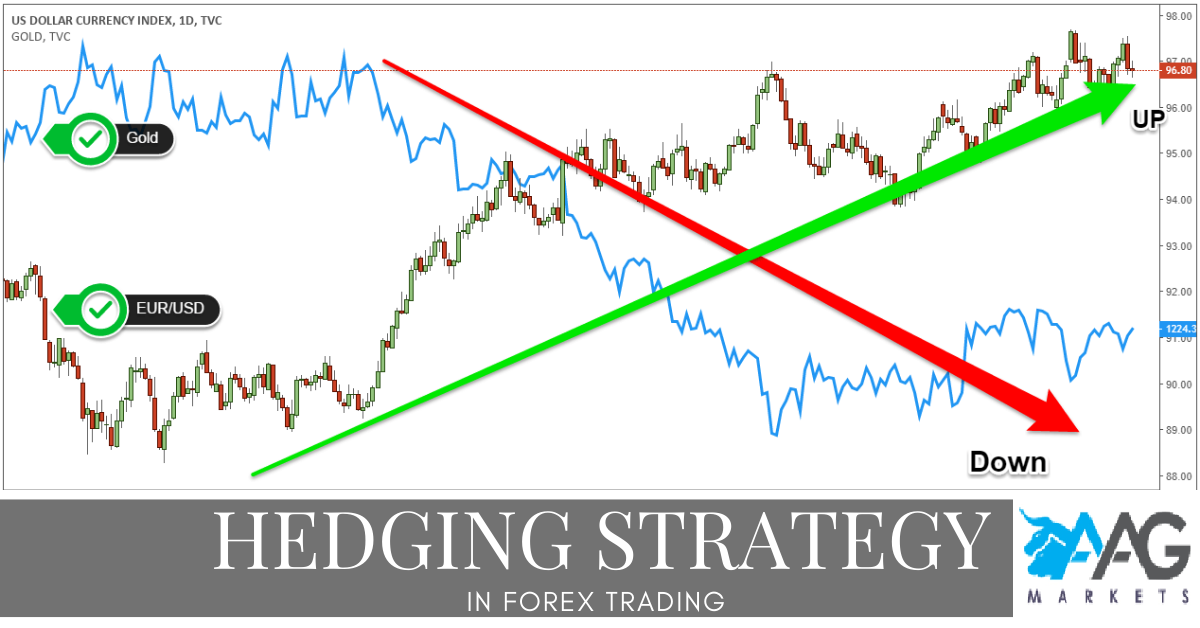

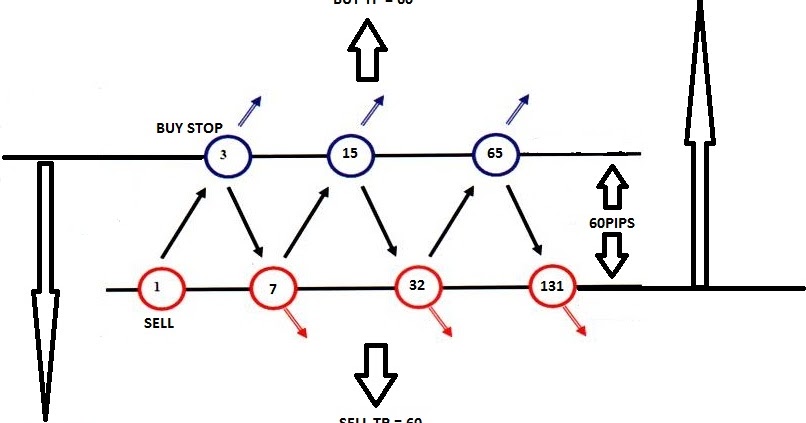

The simple forex hedging strategy allows traders, as well as FX Expert Advisors, to generate profits on the new trade even as the first trade makes losses. The term " hedging " refers to the process where a forex broker reduces market risk exposure by entering into a parallel transaction with another entity (a "liquidity provider"). Generally, the objective of hedging is to take a position on two dissimilar i

nstruments that have.

.png)