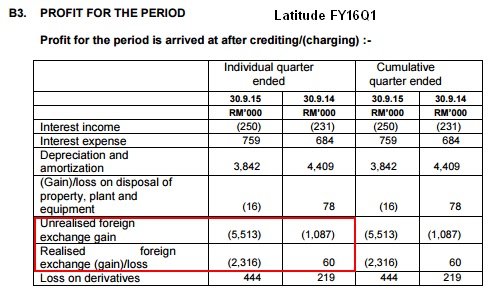

Forex Gain Or Loss Accounting. The two situations in which you should not recognize a gain or loss on a foreign currency transaction are: When a foreign currency transaction is designed to be an economic hedge of a net investment in a foreign entity, and is effective as such; or. But, the gain/loss on FX is posting while the bill is still sitting as AP.

When you post receipts, the system calculates gains and losses based on. Foreign exchange gain or loss accounting exampleForeign exchange fluctuation is a difference between rate of currency at the time of sale (Export) and the ra. A change in the fair value of equity or debt.

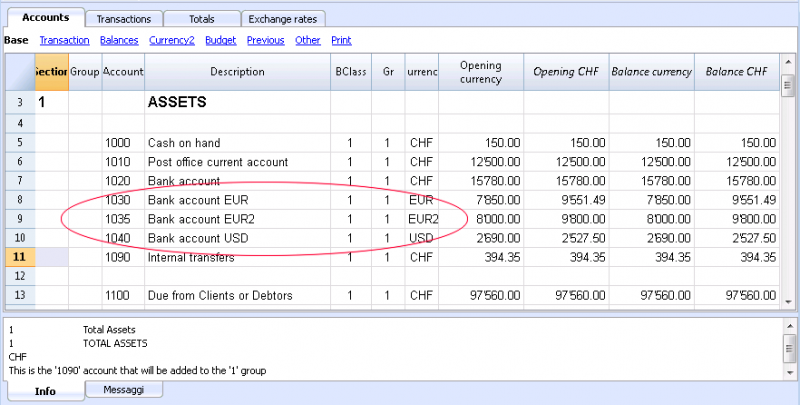

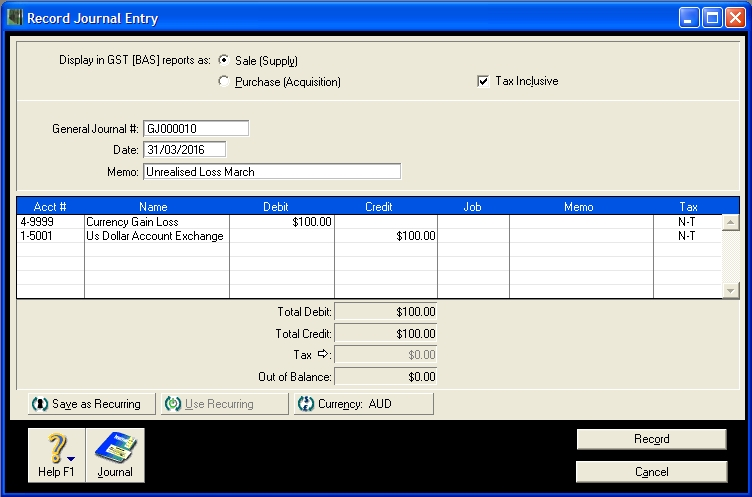

As per accounting standard, you will need to record a transaction to account for such forex gains or losses.

Create a Forex Gain Loss Ledger under Indirect Income/Indirect Expense as the case may be.

Foreign exchange gains and losses are referred to as losses that are incurred when a company purchases goods and services in foreign currency. You have to adjust the Forex Gain /Loss by doing the following. A foreign exchange gain or loss accounting example is when the EUR customer pays the invoice to the US seller.