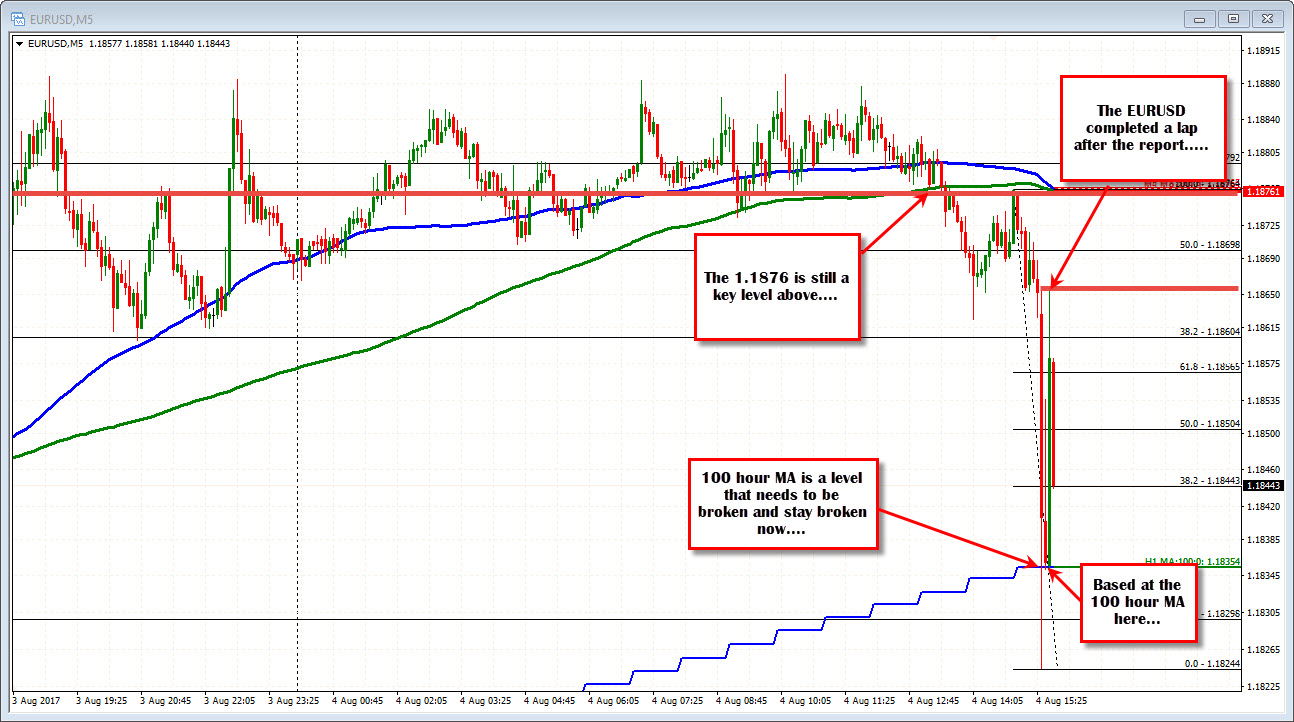

Forex Gains And Losses. Aspiring forex traders might want to consider tax implications before getting started. But for tax purposes, the currency recognition and.

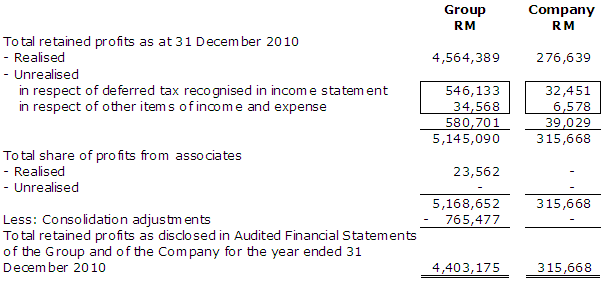

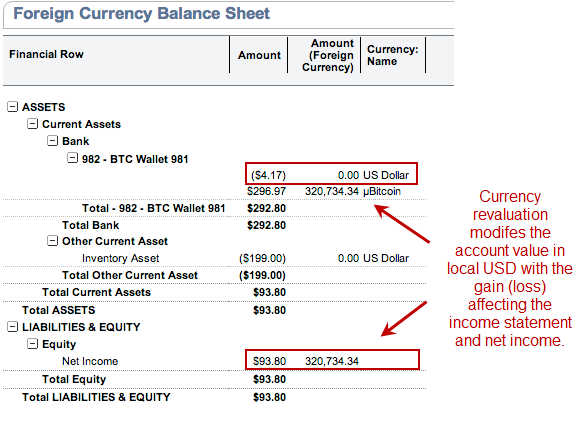

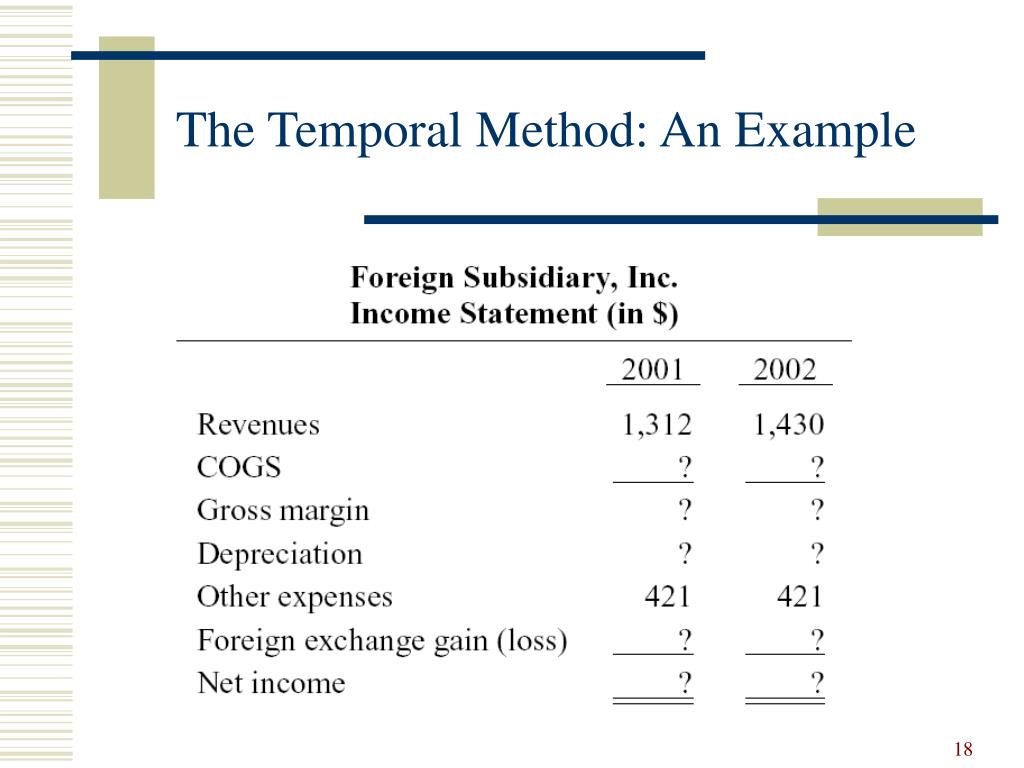

Foreign exchange gains or losses relating to securities measured at fair value and equity-accounted investments are part of the fair value measurement or equity method of accounting. The foreign currency gains and losses need to be recognised in the financial reporting on the company. The currency fluctuation exists on a normal basis, and as a result of this fluctuation, there is a difference in monetary assets and liabilities, which.

Foreign exchange gains and losses are referred to as losses that are incurred when a company purchases goods and services in foreign currency.

Reporting Gains and Losses Foreign Exchange Gains or Losses.

You can use the search field in the top right corner. It will show you the realized gain and loss that you've made within the selected period. Go to General Ledger > Journal Entry.