Forex Vs Stock Market. Forex and the stock market have some distinct differences traders should know. However, forex also comes with a much higher level of leverage and less traders tend to focus less on risk management , making it a riskier investment that could have adverse effects.

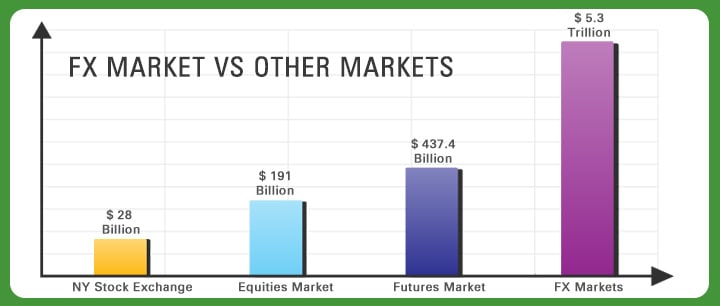

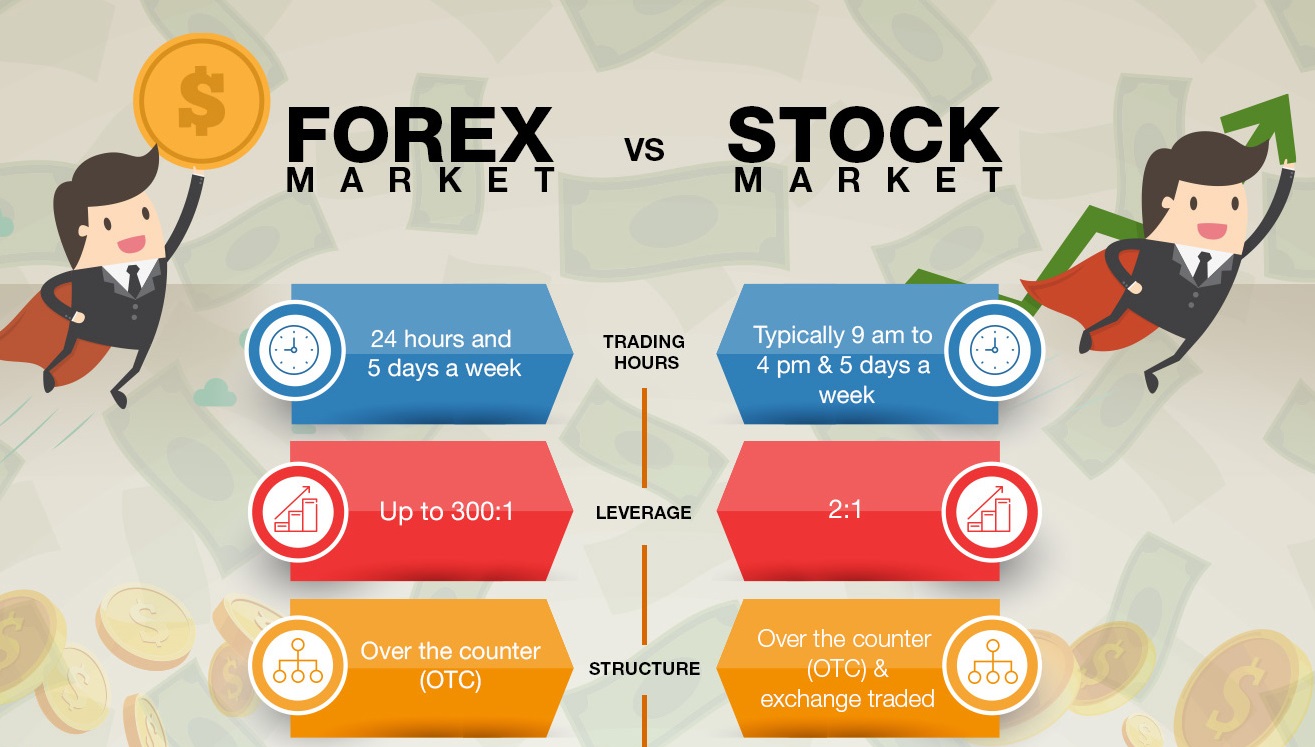

What Is the Difference Between Forex and the Stock Market? The key differences between trading Forex and Stocks are that Forex tends to possess higher liquidity, volatility, better leverage options and longer trading sessions as compared to stocks. Forex, or foreign exchange, is a marketplace for the buying and selling of currencies, while the stock market deals in shares – the units of ownership in a company.

Truly speaking, Forex is not as popular as stock.

The best way to compare Forex trading vs stock trading is to consider their pros and cons.

As a result, it makes the forex market highly profitable but with high risk. The stock market is attracting many traders on the day to day basis as it is characterized by many swings and fluctuations. Aside from how the markets are structured, there are plenty of risks and advantages to both.