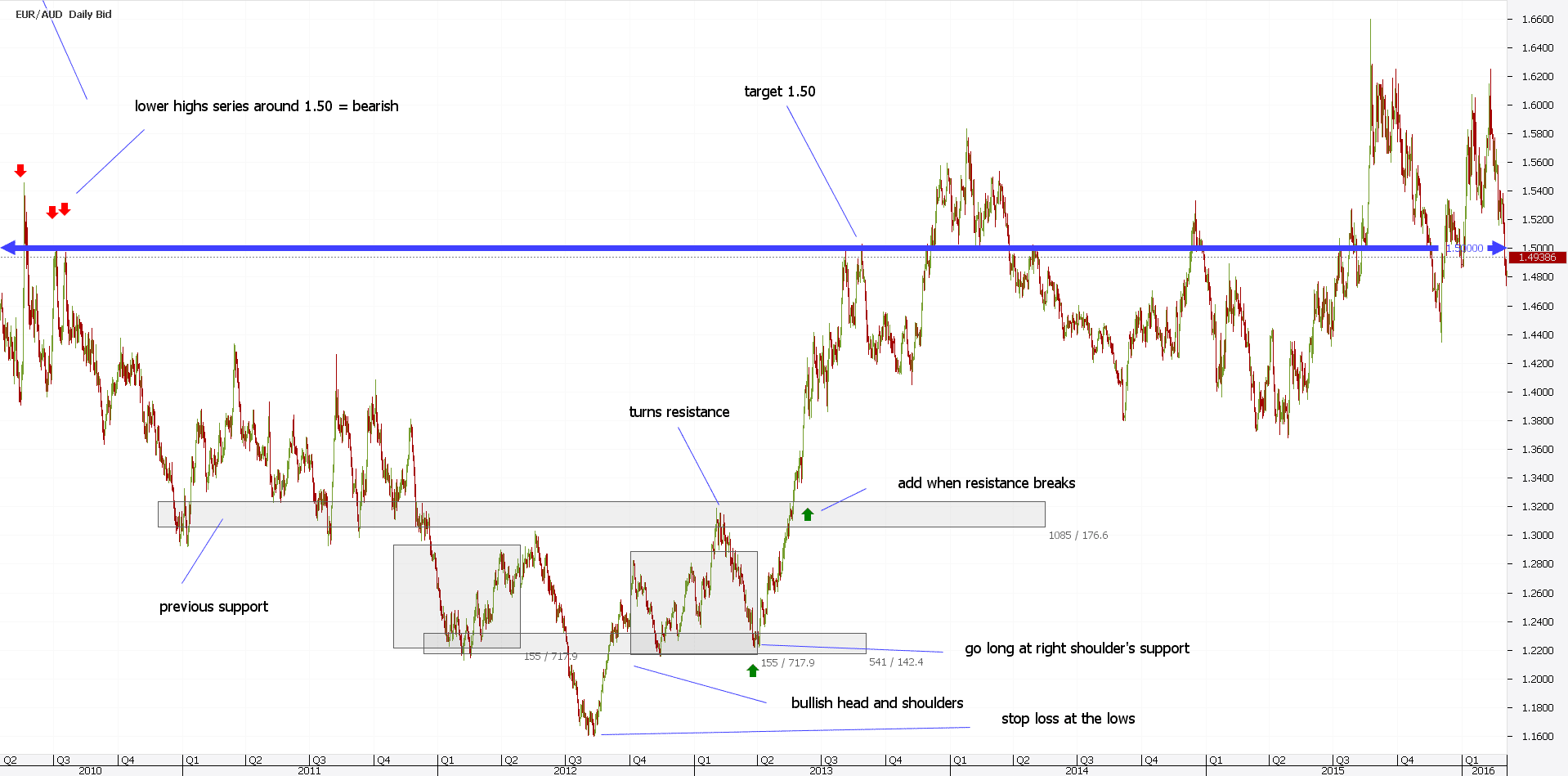

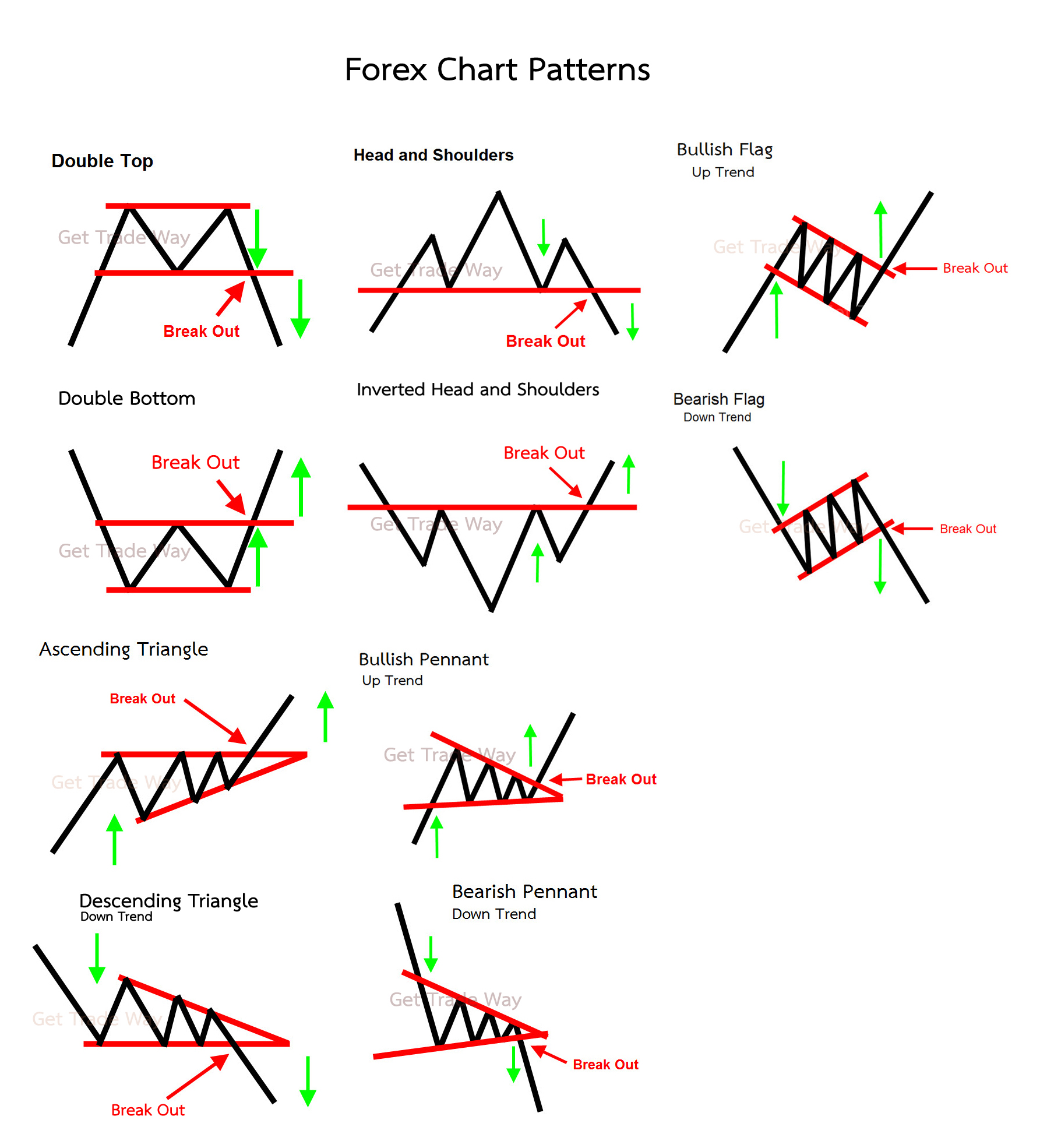

Forex Price Action Patterns. Here's why it works: Imagine, the price makes a strong bullish move into resistance—and breaks out higher. And these lower highs can sometimes form the Bear Flag. different price action patterns that form in the market.

Candlestick patterns like Hammer, Hanging man, Harami, Pin tops, and. When done correctly this pattern can be incredibly reliable. The inverse cup and handle is the opposite chart pattern, indicating a bearish trend.

In price action trading, price is of utmost importance to the trader/analyst.

This Price Action pattern consists of two bars, the lows or highs of which are on the same level.

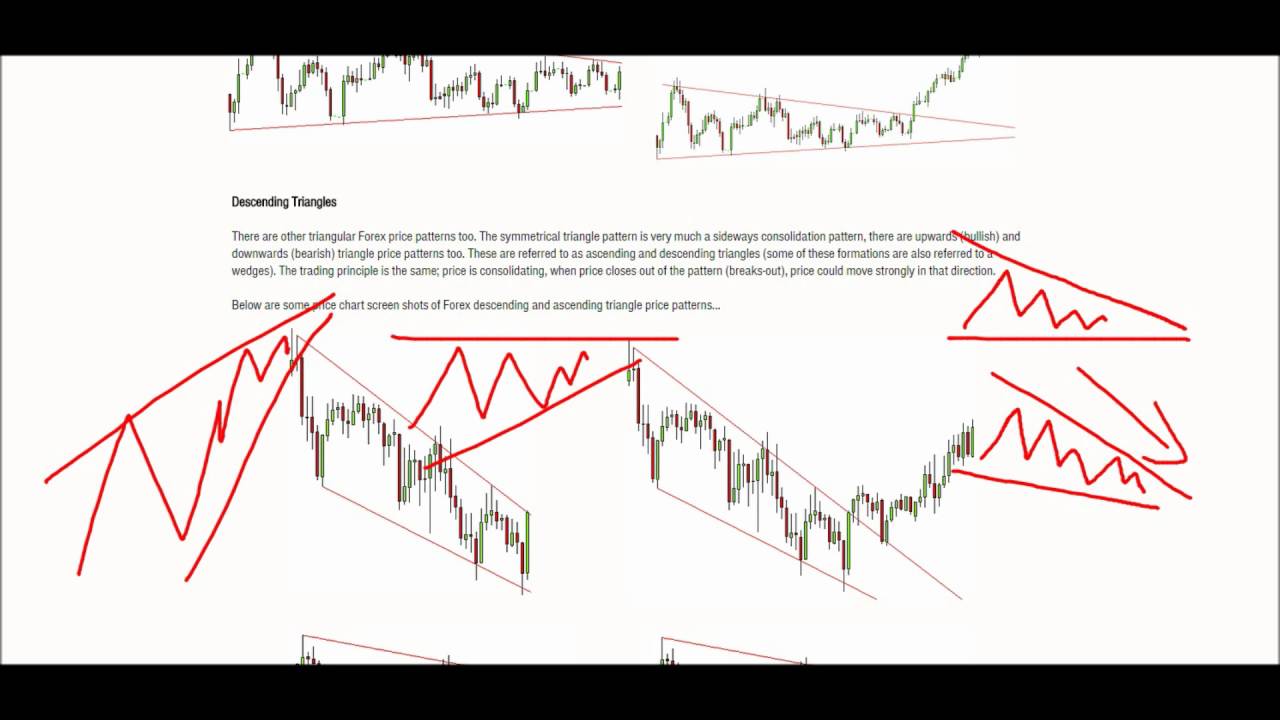

So look right here, we have a descending triangle. In a downtrend, the market will continually make lower lows and lower highs. The problem with these pattern, is that because there are so many of them that form in the market,.