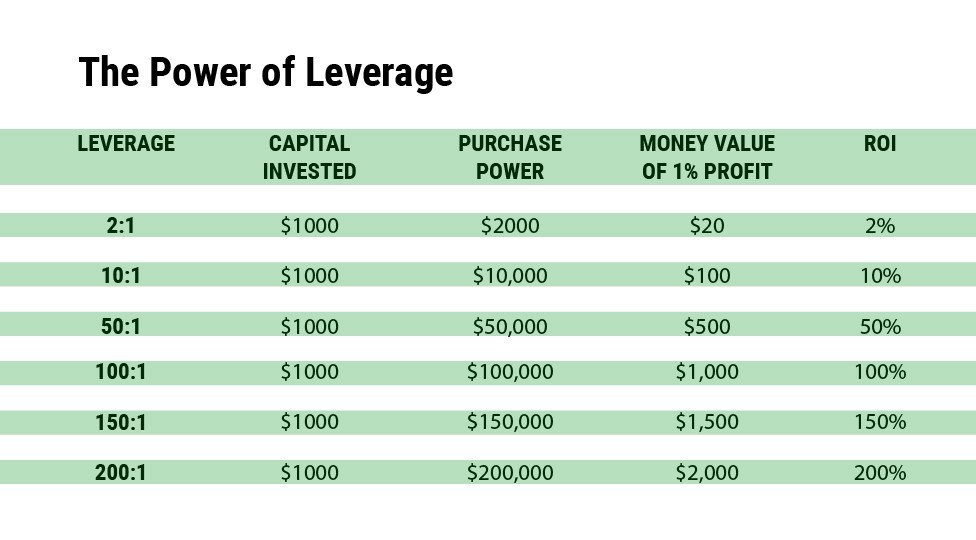

Over Leveraging Forex. High leverage works against the speculator by increasing the stakes and making the heart beat faster. However, it can just as easily amplify your losses.

However, it can just as easily amplify your losses. It's called leverage because the borrowed amount usually outweighs the amount you contributed Remember, over-leveraging is one of the most dangerous things you can do as a forex trader. As we've seen, leverage is a powerful tool that can help you win big in the forex market.

By using leveraging carefully, you maximize potential profits and minimize potential losses.

However, it can just as easily amplify your losses.

Another key advantage of leverage as far as forex trading in particular is concerned is that it has the effect of mitigating against low volatility. Obviously, the second trade forex a much smaller trade size than the first, but when you over-leverage your Forex account, over losing trade damages your capital base to the point where you need to change

your trade size or deposit more funds. Leverage allows you to open positions beyond the limitations of your available account balance.