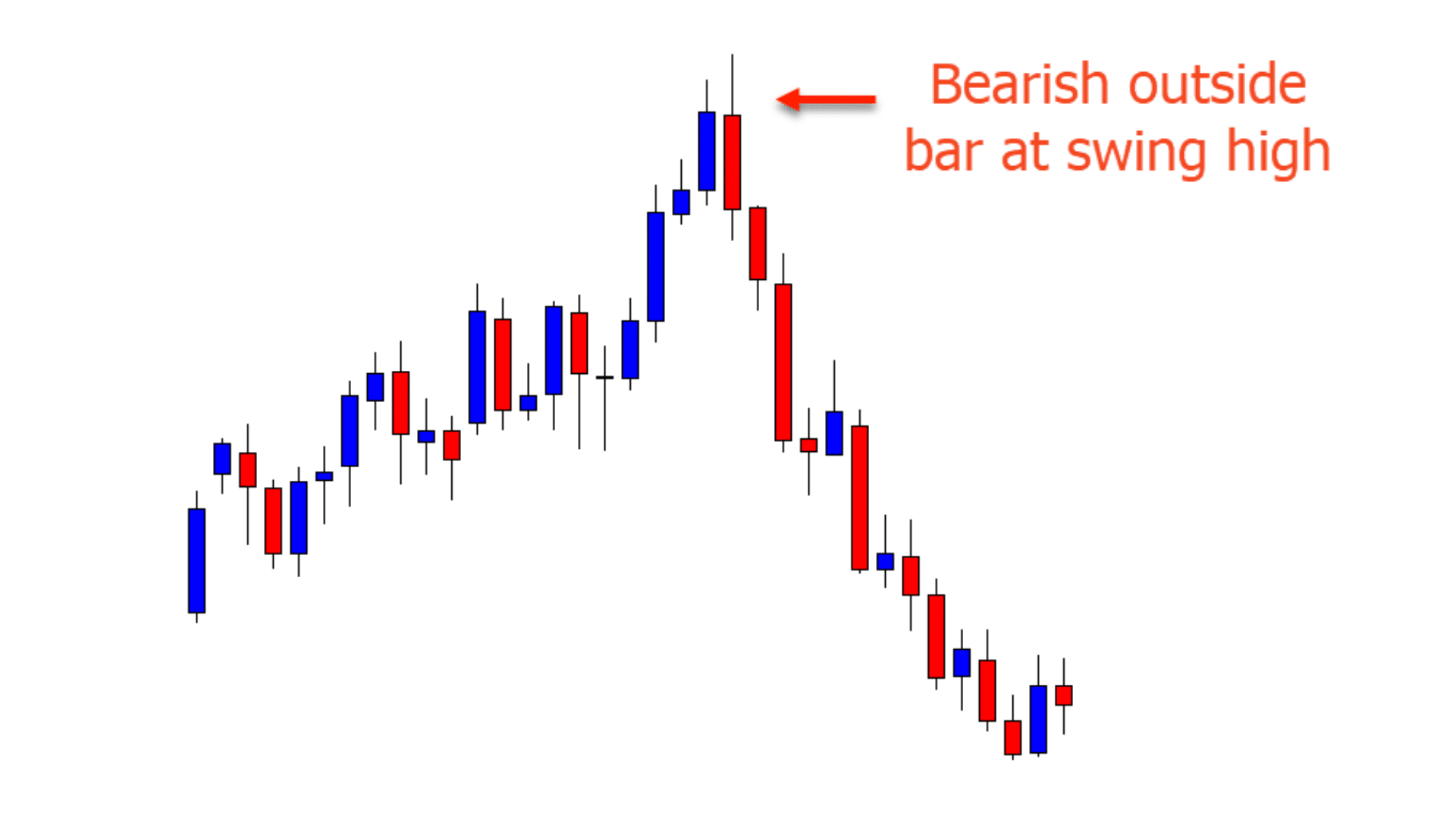

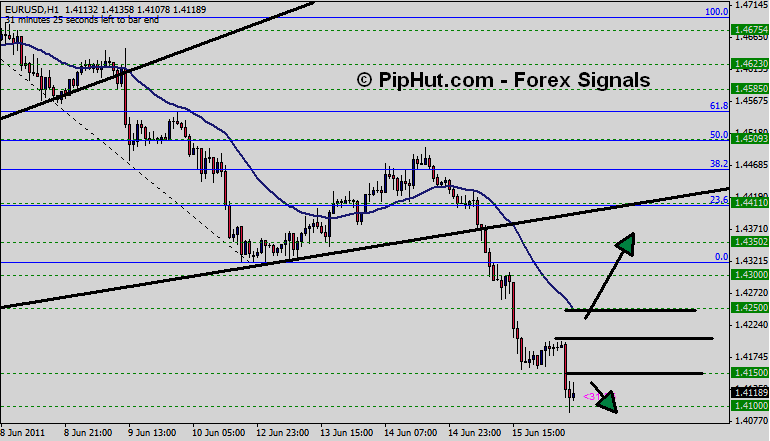

Forex Outside Bar. It can be both a bullish reversal pattern, a bearish reversal, or even be used during a continuation move from some type of consolidation. In this article, we discuss the use of candlestick outside bars in Forex trading and its use as a powerful price predictive indicator.

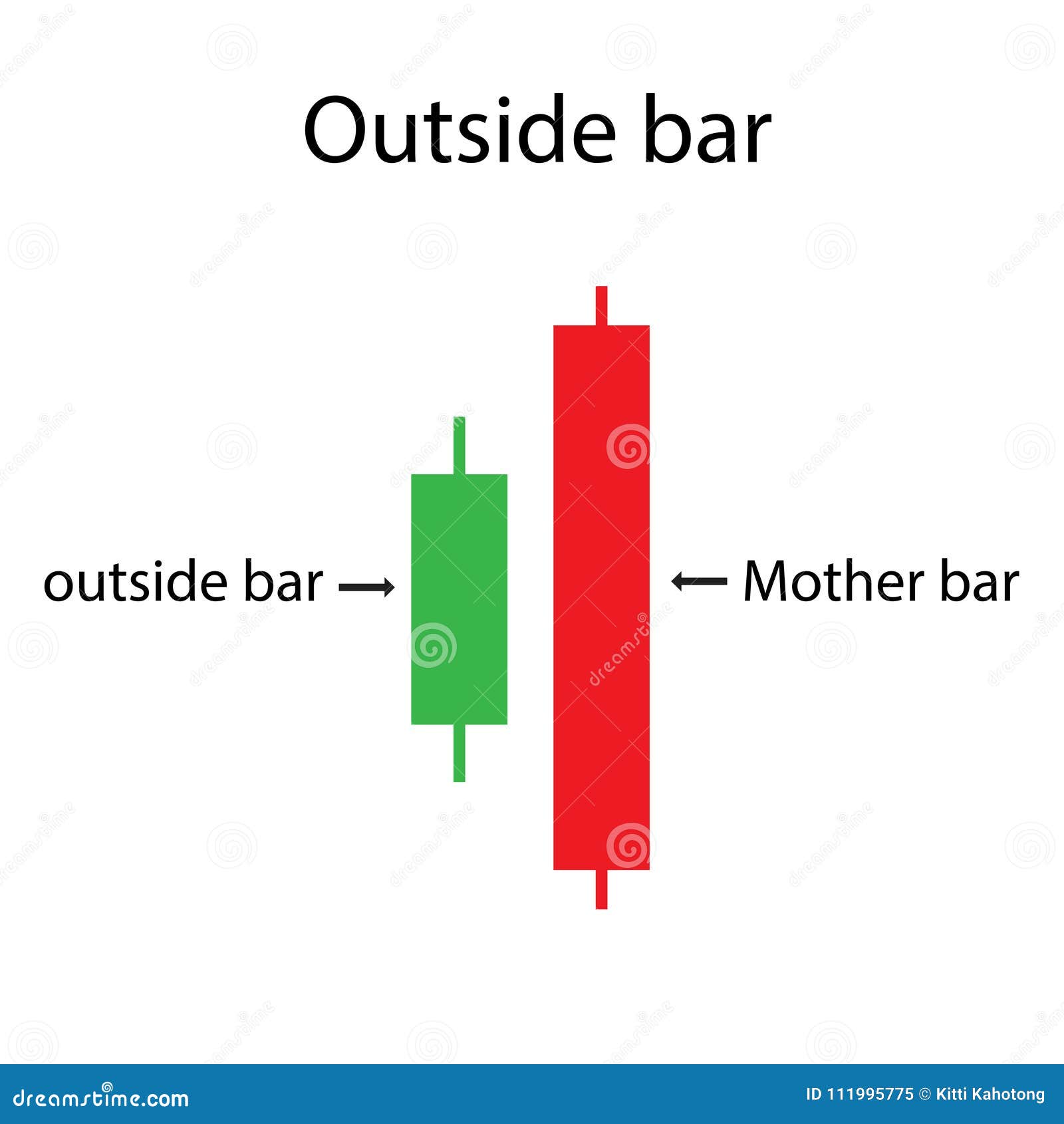

This means the Outside Bar's high and low engulf the bar that precedes it. And as you'll soon learn, this pattern is often signifying a trend continuation or a reversal. What this means is that the outside bar's high and low overshadow or engulfs the bar before it.

Definition An outside bar candlestick pattern occurs when the candlestick of a given trading session is larger than the prior trading session's, creating an engulfing candle pattern.

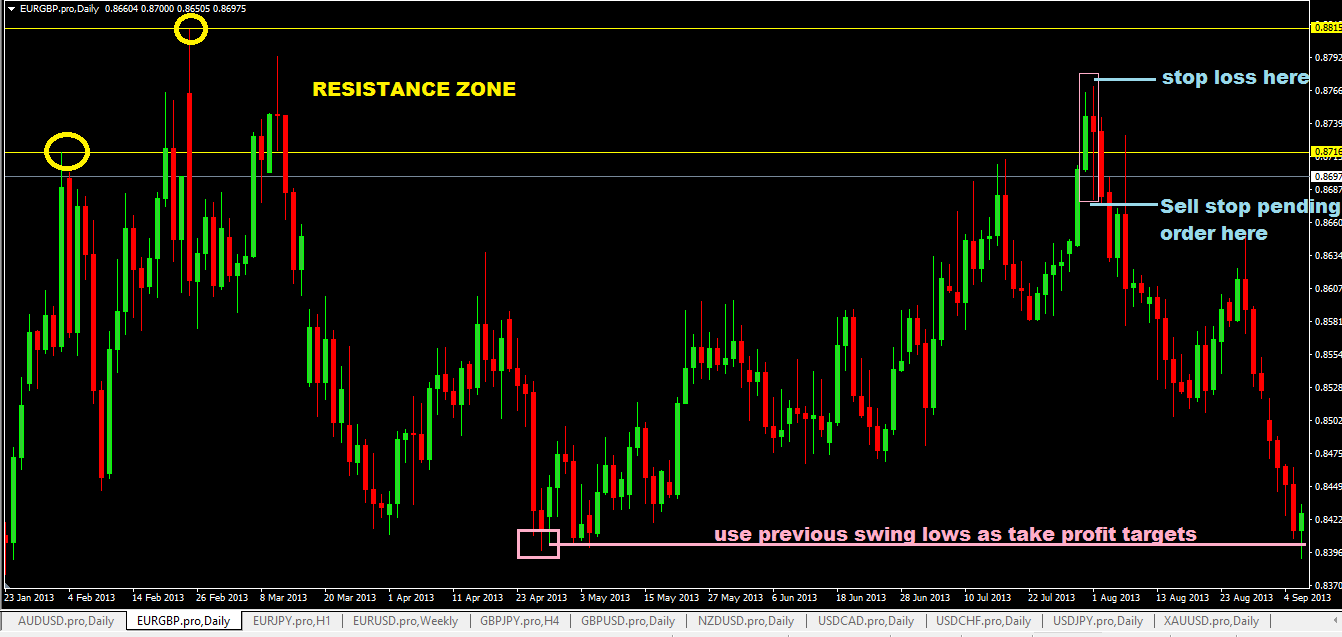

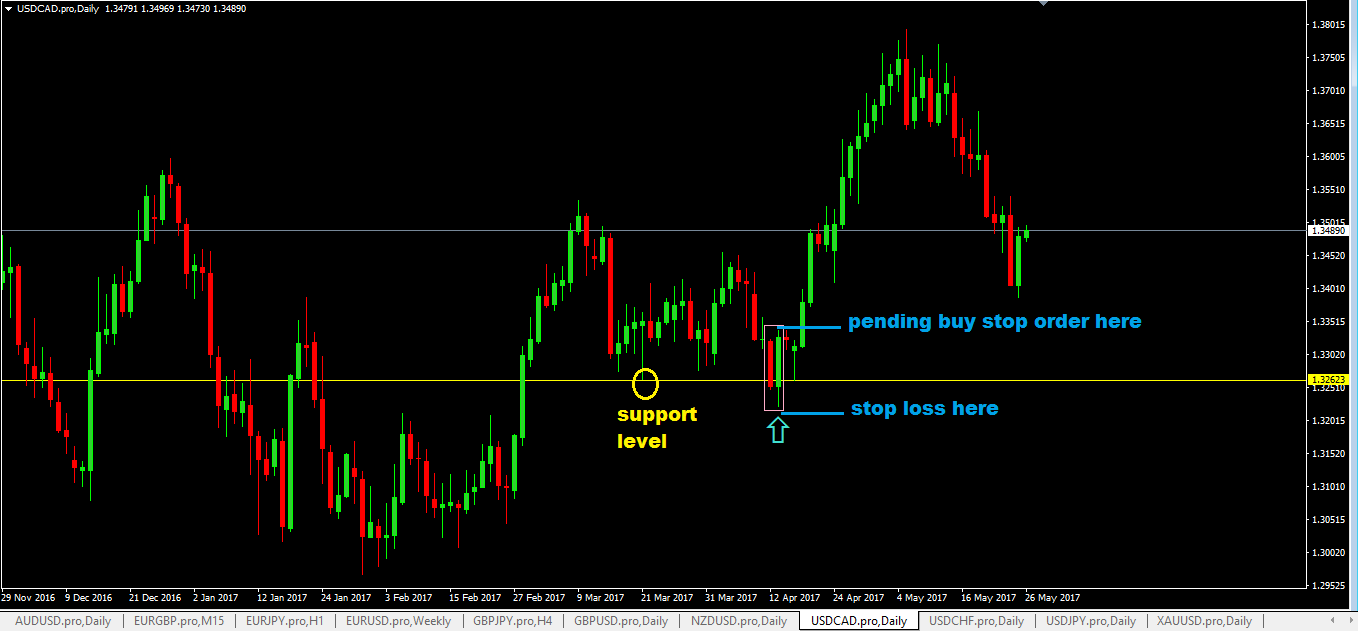

OutSide Bar Bullish Forex Indicator:OutSide bar is red (delete colur blue of indside bar) Bearish Outside Bar The second bar engulfs the first bars High/Low range The second bars "Open" must be above "Close" of first bar (first bar can be bull or bear) The Outside Vertical Bar and How to Trade Them By James Stanley Few Candlestick patterns can excite traders as much as the Engulfing pattern, or also known as the 'Outside Vertical Bar.' This is a.

Therefore, we would have played a pending sell order on the break of. The outside bar candlestick pattern makes use of the bullish and bearish engulfing candlesticks, two of the most powerful candlestick patterns in forex. What this means is that the outside bar's high and low overshadow or engulfs the bar before it.