Stop Out In Forex. To understand when this happens, you need to get to the bottom of margin trading and its unique features. This liquidation happens because the trading account can no longer support the open positions due to a lack of margin.

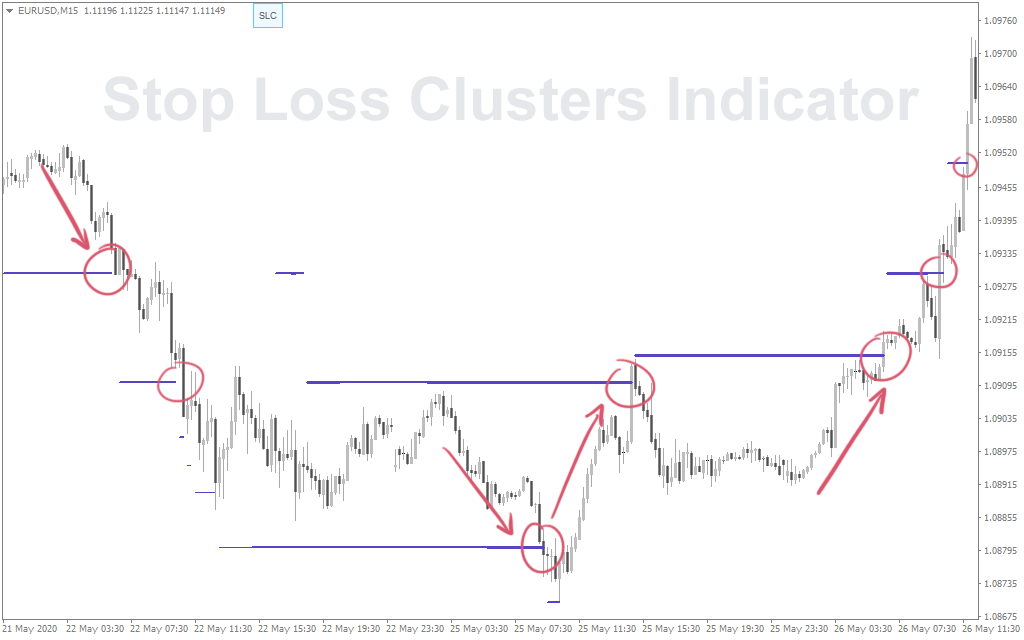

This will produce the window on the right. A Forex stop out is when all of a trader's active positions in the foreign exchange market are automatically closed by their broker. They can then ride the resulting frenzy until it pans out and they can take their profits.

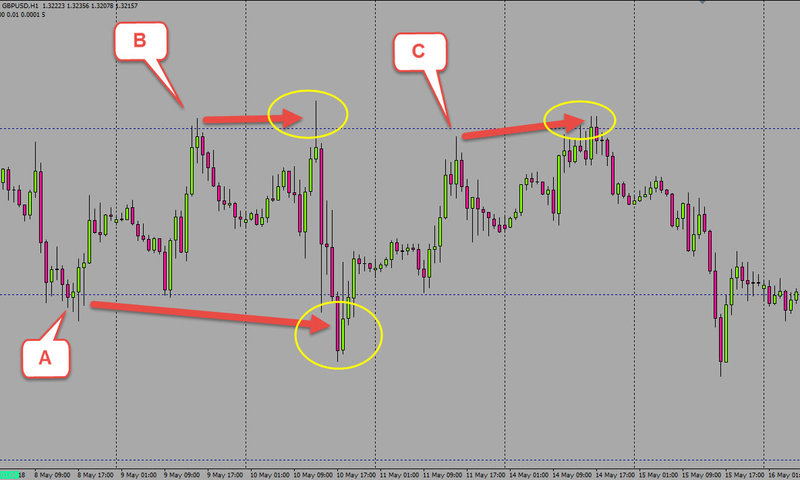

In forex trading, a Stop Out Level is when your Margin Level falls to a specific percentage (%) level in which one or all of your open positions are closed automatically ("liquidated") by your broker.

The level at which the stop out is enacted.

In forex trading, a Stop Out Level is when your Margin Level falls to a specific percentage (%) level in which one or all of your open positions are closed automatically ("liquidated") by your broker. In forex trading, a Stop Out Level is when your Margin Level falls to a specific percentage (%) level in which one or all of your open positions are closed automatically ("liquidated&

#34;) by your broker. Leverage means that the trader is trading a position with money that they do not technically have.