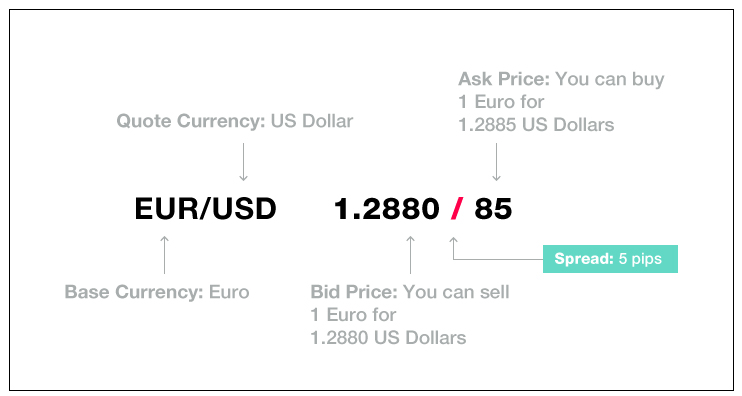

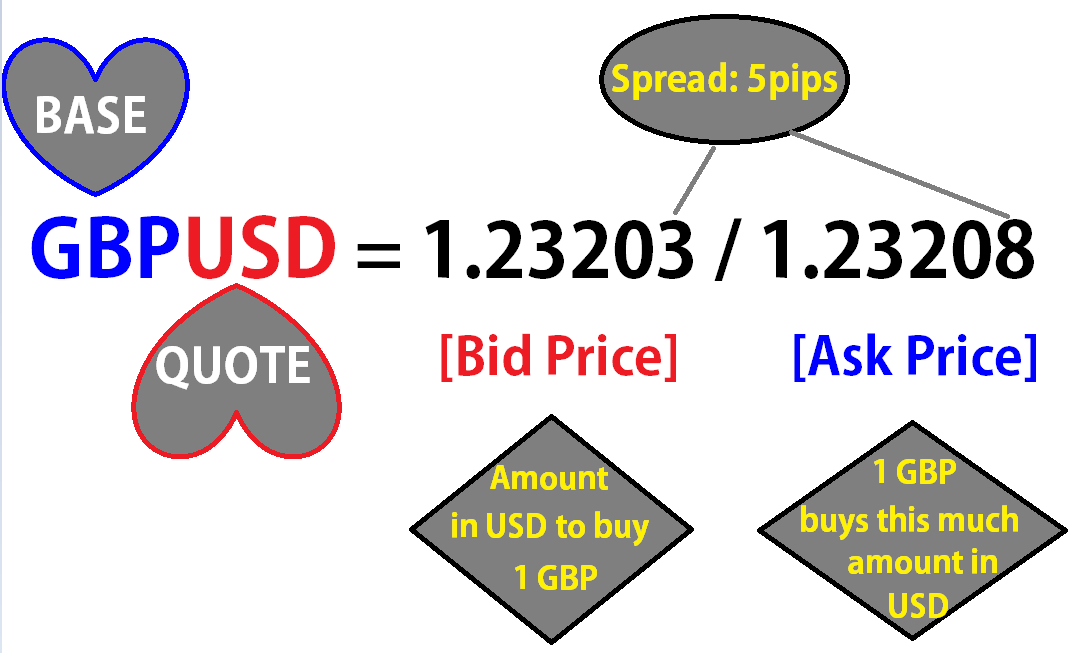

In Forex Market The Ask Rate Is Always. The ask price is a fairly good indicator of a stock's value at a given time, although it can't necessarily be taken as its true value. Ask Price -Used when buying a currency pair.

To calculate the percentage discrepancy, take the difference between the two exchange rates, and. Not all Forex Brokers quote rates the same way. Ask Price -Used when buying a currency pair.

It reflects the amount of quoted currency that has to be paid in order to buy one unit of the base currency.

Generally, the ask rate in foreign exchange is higher than the bid rate, simply because a broker needs to run on some sort of a commission, which is called a Forex bid ask spread.

Currencies are most commonly national currencies, but may be sub-national as in the case of Hong Kong or supra-national as in the case of the euro. The Ask Price The ask price is the lowest price that someone is willing to

sell a stock for (at that moment). Bid-ask spread is the amount (in rupees or paise) by which the best ask rate (lowest sell price) exceeds the best bid rate (highest buy price) of a security at any given moment.

/GettyImages-168304532-5902254b5f9b5810dc944eff.jpg)