Forex Derivatives. These underlying assets can range from commodities to equity indices, even currencies. A forex derivative derives its value from the fluctuations in the currency exchange rates of two or more currencies.

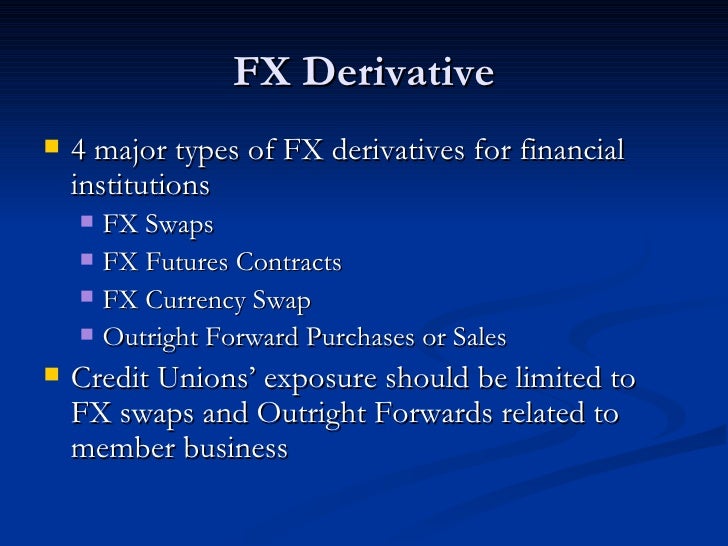

A derivative is a financial contract with a value that's based on an underlying asset. Often, a strategic combination employing one or more of the above derivative instruments along with spot forex positions can be used by forex traders to maximize profits, minimize risks and generally adjust their overall risk profile. Currency derivatives are contracts to buy or sell currencies at a future date.

The return of exotic forex derivatives as well as the introduction of swaptions are part of efforts to give corporates more risk-management options as India's global trade integration expands.

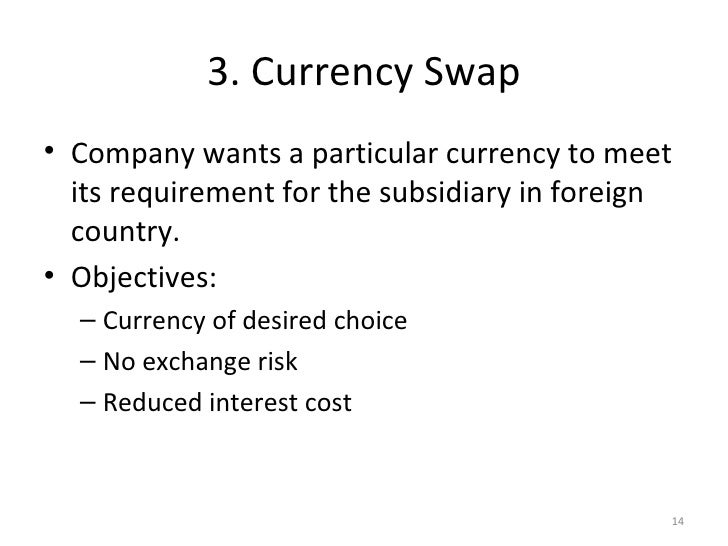

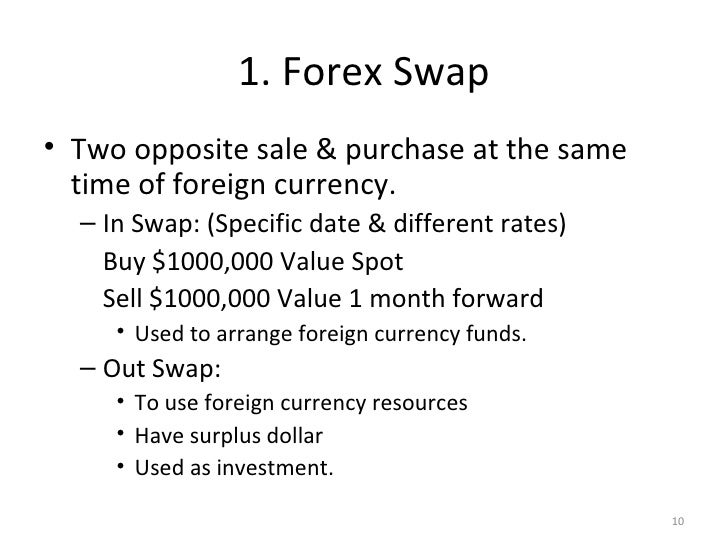

The most common Forex derivatives are forwards, futures, swaps and options.

Demand for currency derivatives has shot up this year, data from CME Group showed on Wednesday, in a sign investors are positioning for hefty interest rate hikes from the U. The spot market is just one part of the entire global forex market, albeit the biggest and most well known. The difference between this rate and the actual market rate on this date will determine who comes off.