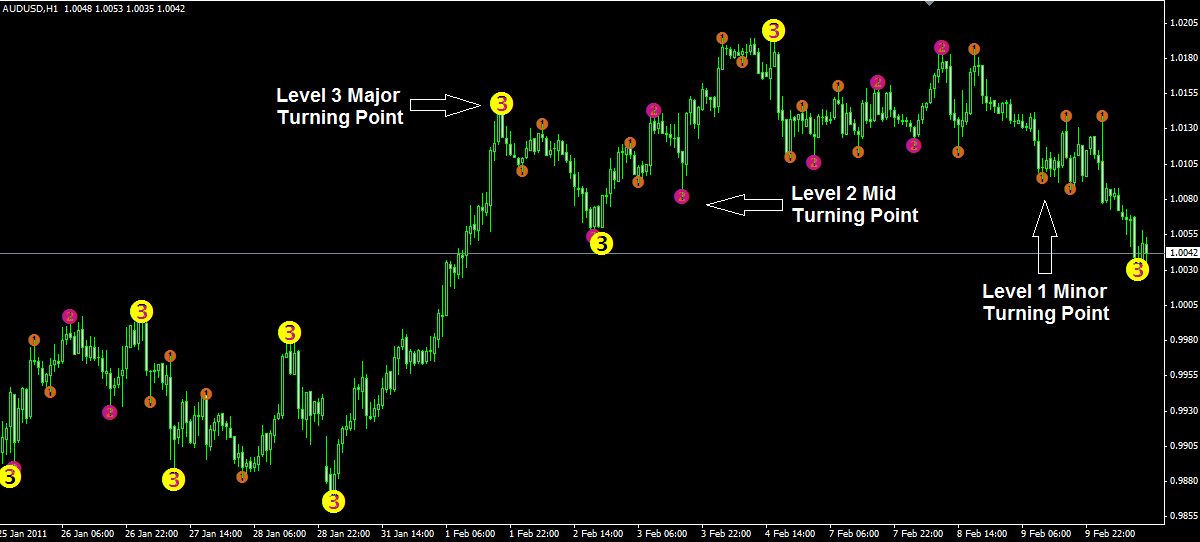

Forex Turning Points. Trading turning points refers to any time the price trends in a specific direction and then clearly changes direction and trends in the other direction. Turning points and Divergence Indicator Forex System can be used on any Forex currency pair and other assets such as stocks, commodities, cryptos, precious metals, oil, gas, etc.

In another words, it is the good point to detect the directional change in the market. This is often referred to retractment, retracement, bounce or turning point trading. A pivot point is an indicator developed by floor traders in the commodities markets to determine potential turning points.

Trading turning points refers to any time the price trends in a specific direction and then clearly changes direction and trends in the other direction.

However, we can only identify the potential turning point using the.

In another words, it is the good point to detect the directional change in the market. In the end, find turning points in the forex market is the way. In Forex and Stock market, a turning point is a price level in which the market can change its direction from bearish to bullish or from bullish to bear

ish.