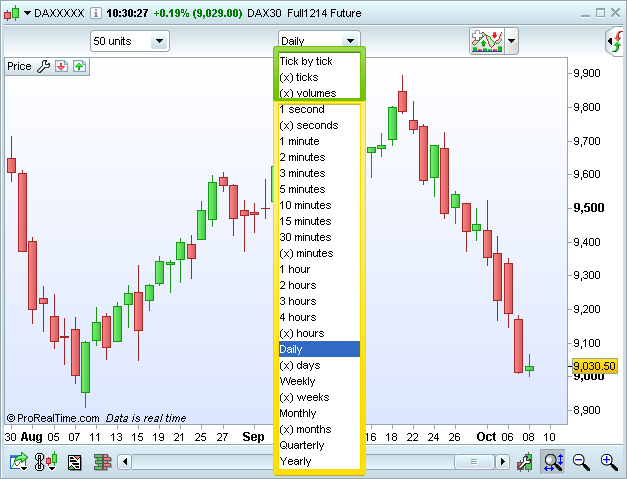

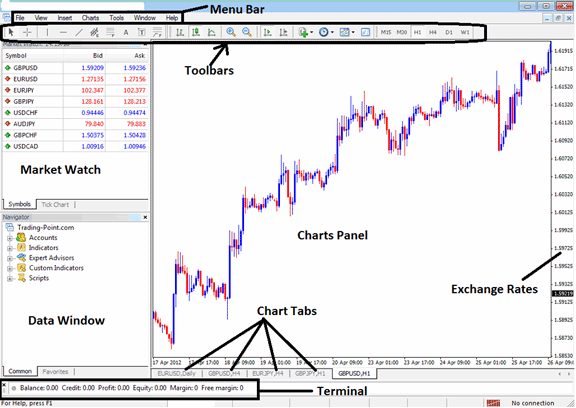

Do Forex Charts Show Transactional Volume. Volume is mainly used to identify momentum in a market's price, with high and low volume signifying. A typical forex chart will show the time period on the x-axis and the exchange rate on the y-axis.. volume, and open interest.

Forex charts also tell you exchange rate levels the market previously reversed to the upside at and below which buyers tend to place bids. A tick in the context of forex tick charts is the change in price of a forex pair caused by a single trade. An uptick is a forex pair trade that is conducted at a higher price than the prior trade.

There are many different patterns, with various suggestions depending on the situation.

A downtick is a forex pair transaction that occurs at a lower price than the prior transaction.

A big difference between a line chart and an OHLC (open, high, low, and close) chart is that the OHLC chart can show volatility. A new bar forms based upon a volume threshold criteria rather than a time interval. If you were looking to see whether a support barrier has.