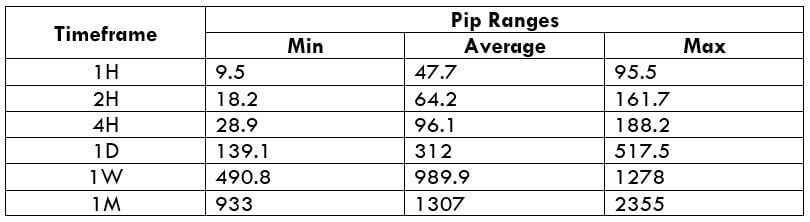

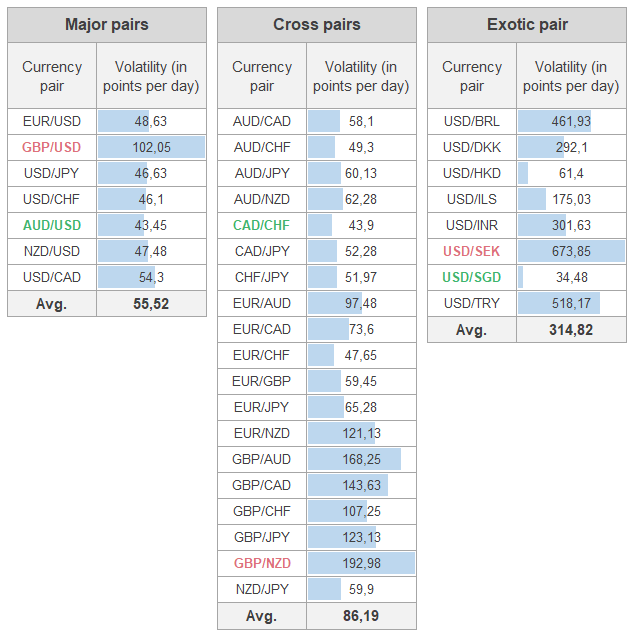

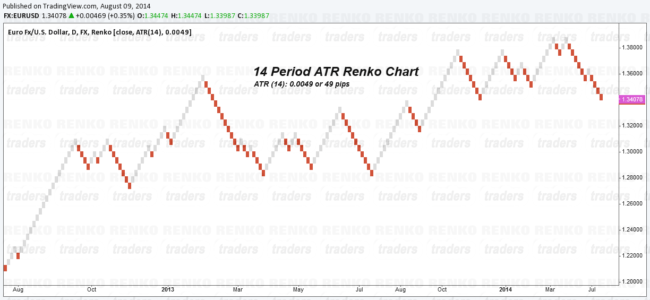

Forex Atr Table. AUD/USD turned out to be the least volatile currency pair. You have to define the period to calculate the average of the volatility.. (ATR).

TR i — true range for the period i. It is calculated by taking the average of the difference between the highest and the lowest of each day over a given period. Forex currency pairs that get lower ATR readings suggest lower market volatility, while currency pairs with higher ATR indicator readings require appropriate trading adjustments according to higher volatility.

TR i — true range for the period i.

AUD/USD turned out to be the least volatile currency pair.

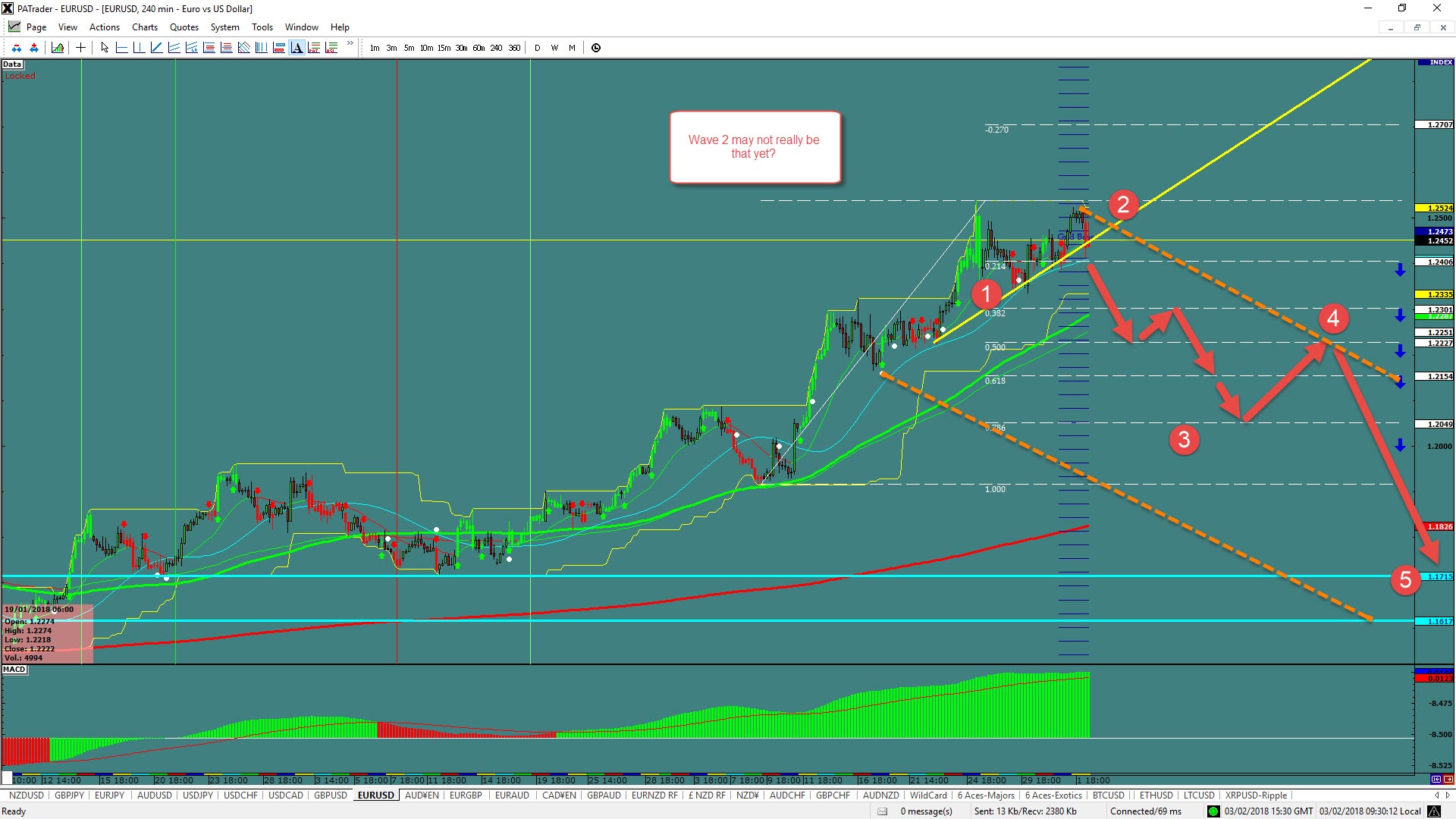

The exact formula how the smoothing factor a is calculated from ATR period n is what makes the two methods different. By default, this indicator plots two levels per day. This can give you an indication of.