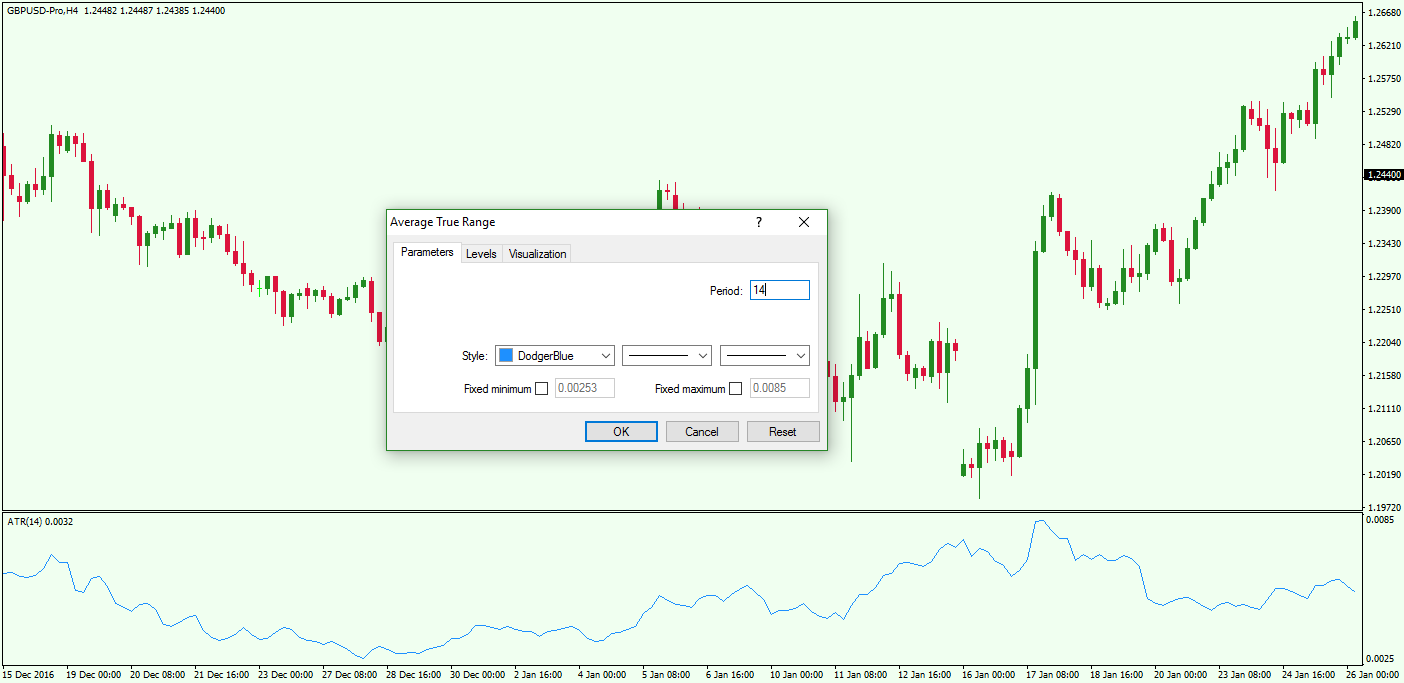

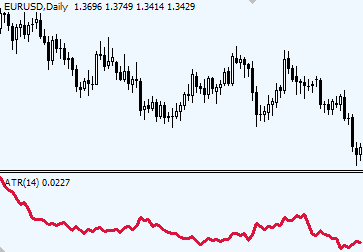

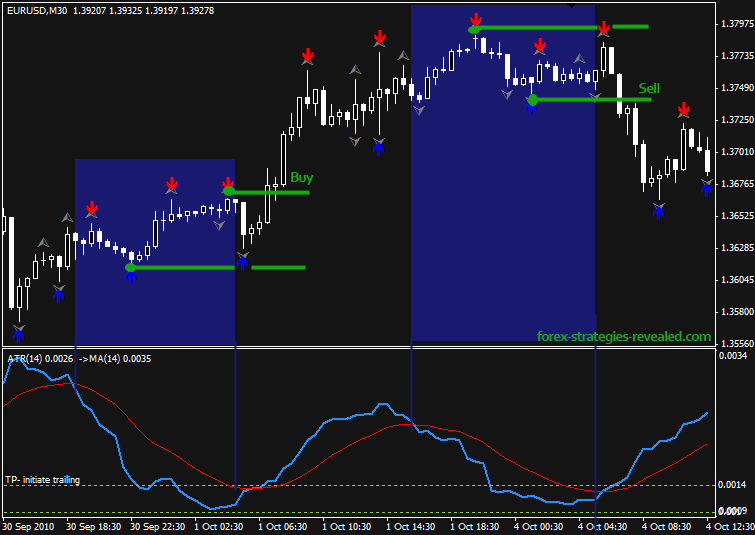

Forex Atr. The Average True Range (ATR) was initially developed for commodity traders to measure market volatility, but traders of other instruments have added ATR to charts to determine volatility as well as to identify possible trend tops and bottoms. ATR, or the Average True Range indicator measures the volatility of a market by measuring the price range for a defined amount of candlesticks.

The Average True Range (ATR)is a technical indicator that measures the volatility of an asset's price. It can be calculated, and it's found in a lot of charting software. Simply put, the ATR indicator measures the volatility of price changes of any security or market.

It works for futures, forex, and equities.

While ATR is used with just about any time frame, the original.

It can be calculated, and it's found in a lot of charting software. We wanted

to get this blog up now to give context to future blogs. The ATR reflects the market volatility in terms of average price.