Forex Arbitrage. One Forex arbitrage strategy involves looking at three different currency pairs. It may be effected in various ways but however it is carried out, the arbitrage seeks to buy currency prices and.

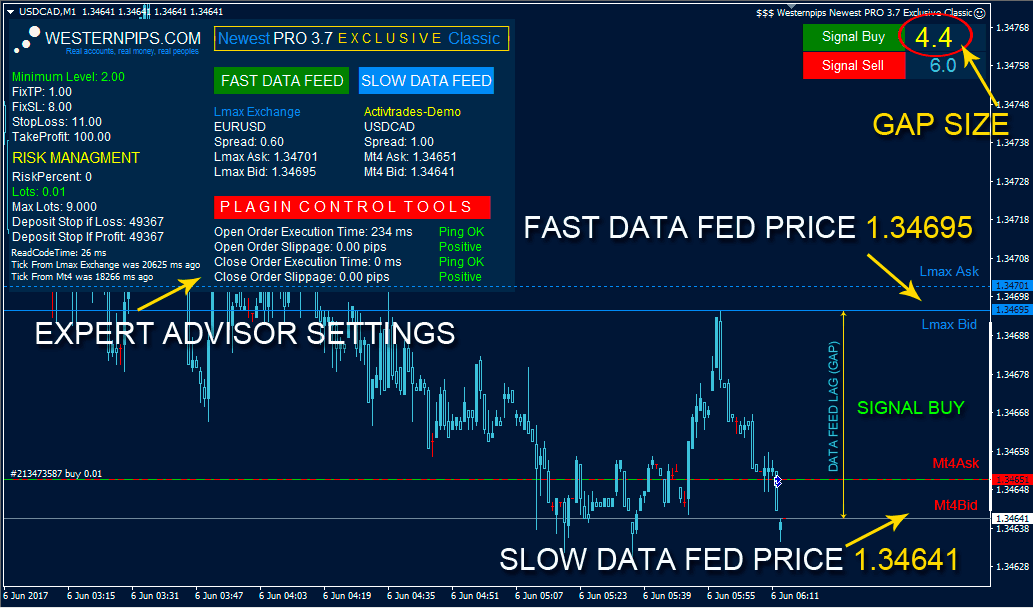

This method of arbitration is much more complicated than the previous type. Such arbitrage forex softwares of this type are designed to beat one of the primary challenges/tasks of arbitrage trading – the accurate and well-timed trade execution that is necessary for. Forex broker arbitrage is not the only type of opportunity in the spot market though.

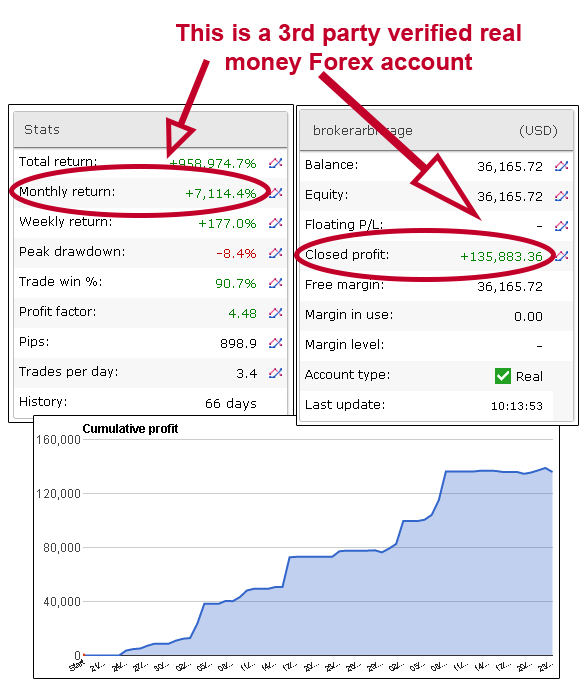

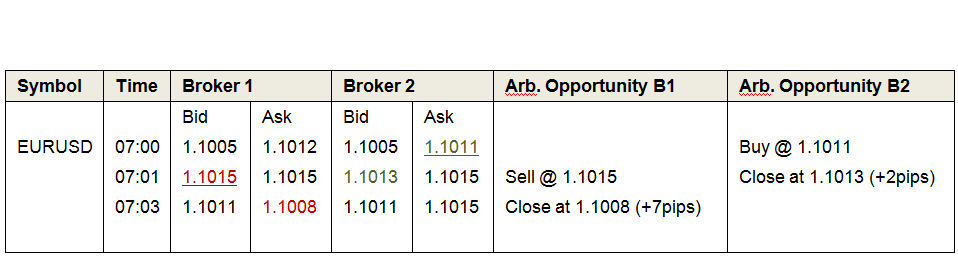

Forex arbitrage explained: Forex arbitrage refers to a process when traders aim to purchase a currency for a cheaper price while selling it more expensively.

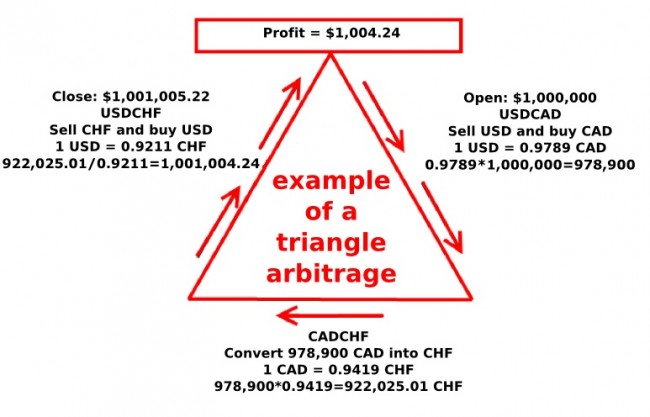

Triangular arbitrage is a trading strategy which takes advantage of the price differences between three currencies in the forex market.

Forex arbitrage is the strategy of exploiting price disparity in the forex markets. The software can be set up to buy and sell at the precise moment that the opportunity arises. Most of those calculators are sold by third-parties, which means that their real-time price.