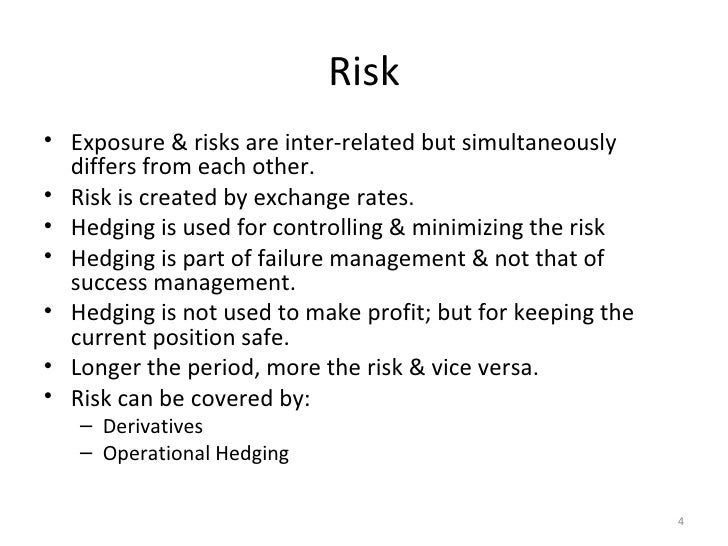

Forex And Derivatives. FX derivatives are forward contracts for the purchase or sale of foreign currency, guided by a specified future timeline. Generally, there would be a slight difference in the exchange rate of a currency in the futures market, compared with the prices quoted in the spot Forex market, as interest rate differentials are factored into the price.

Derivatives trading is a new world of countless speculative opportunities for day traders and swing traders. By using derivative contracts, one can replicate the payoff of the assets. A term you'll hear in forex is the foreign exchange derivative.

Forex derivatives are contracts whose value is decided by the prices of currency pairs they refer to.

Click to see full answer What is considered an OTC derivative?

There are four kinds of participants in a derivatives market: hedgers, speculators, arbitrageurs, and margin traders. Types of Forex Derivatives Futures Contract A futures contract is an agreement to buy or sell a quantity of a currency at a pre-established price on a particular date in the future. A forex derivative derives its value from the fluctuations in the currency exchange rates of two or more currencies.