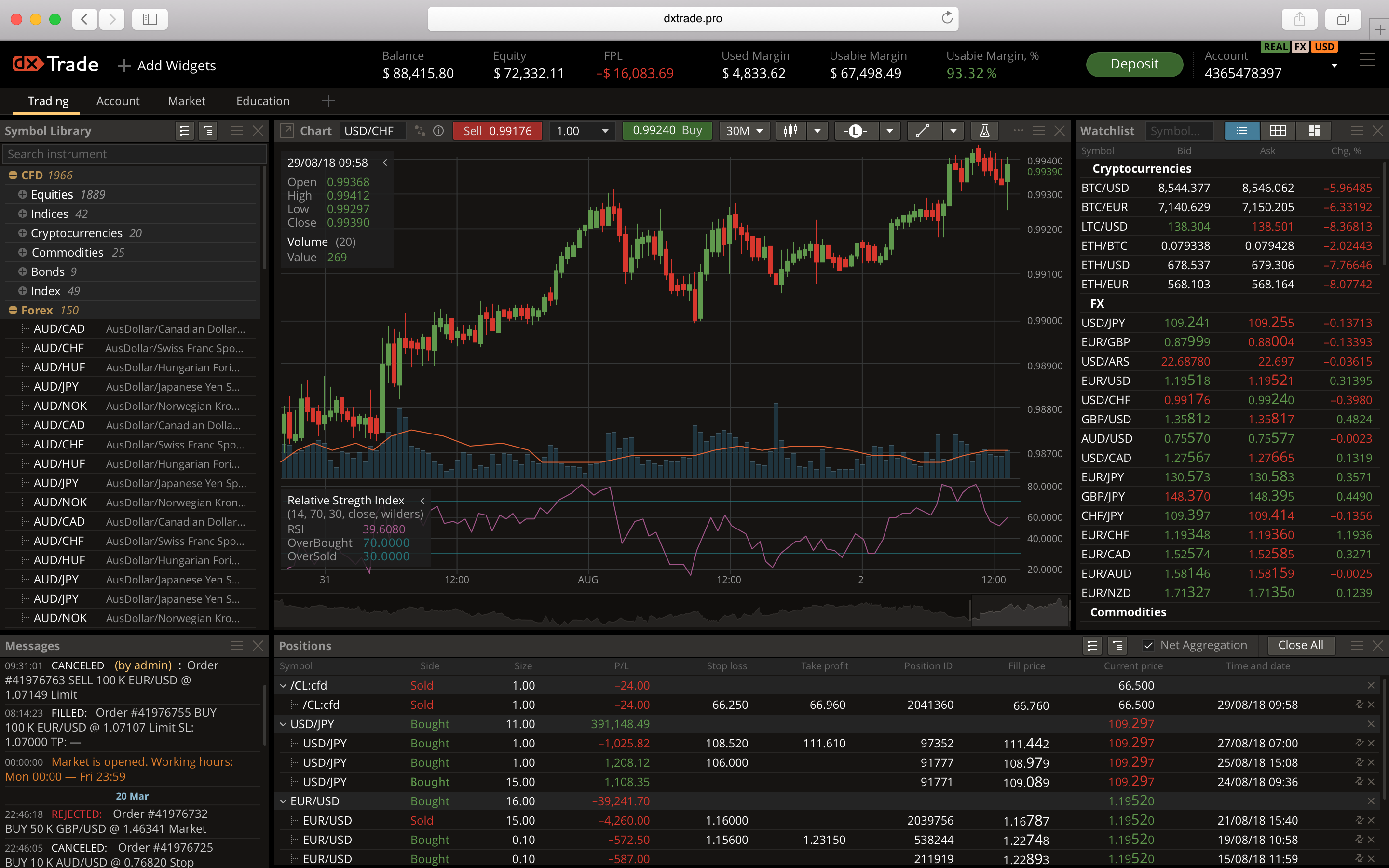

Forex And Cfd. Forex Contracts for Difference (CFDs) are financial tools that allow you to speculate on the price movements of currency pairs. However, CFD has a much wider choice of assets you can trade with.

However, it does have some advantages over spot forex, such as the ability to trade on leverage and to go long or short on a currency pair. Your broker will charge you holding fees for any contracts you choose to hold overnight. Both are conducted on the same spreads in the same procedure.

Both are conducted on the same spreads in the same procedure.

Let me explain this in a few words!

In CFD forex trading, there is no exchange of cash. Stick with what you know With forex, the scope of research is so much narrower and the dependence on economic goings on and current affairs much more substantial. The biggest disadvantage when trading a CFD is the margin needed for a trade.