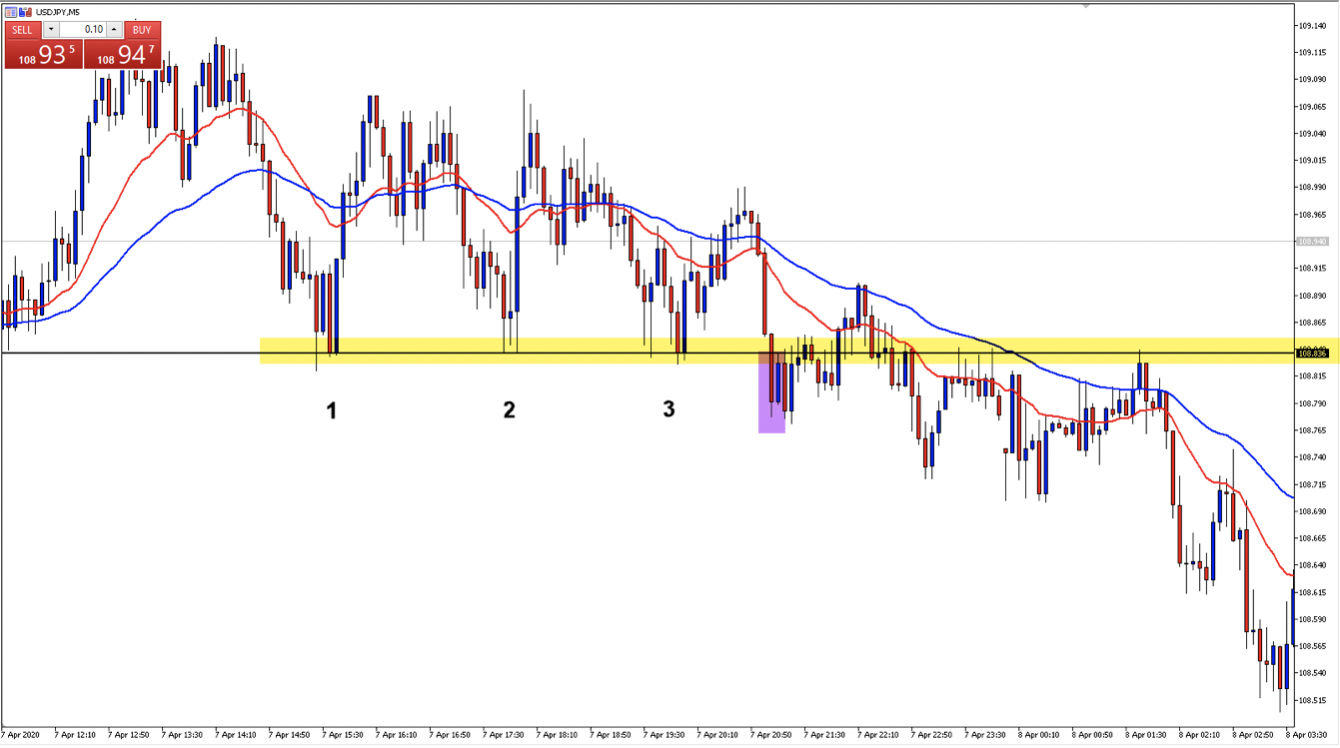

Forex And Cfd Trading. As you can see, the result from each position was the same, but the method of getting there was a little different. Key Difference Between CFDs and Forex.

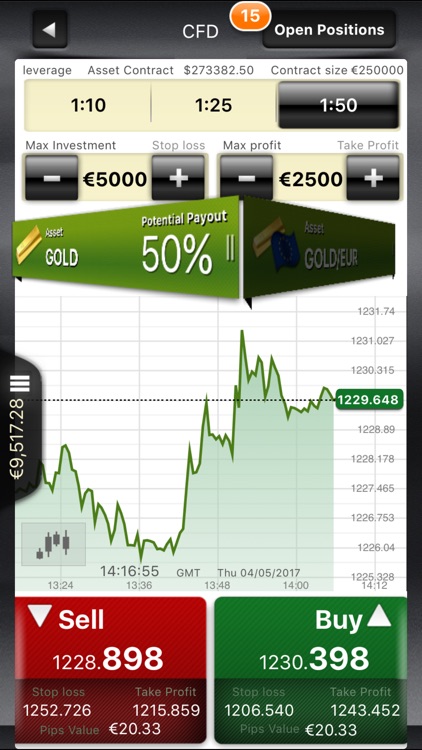

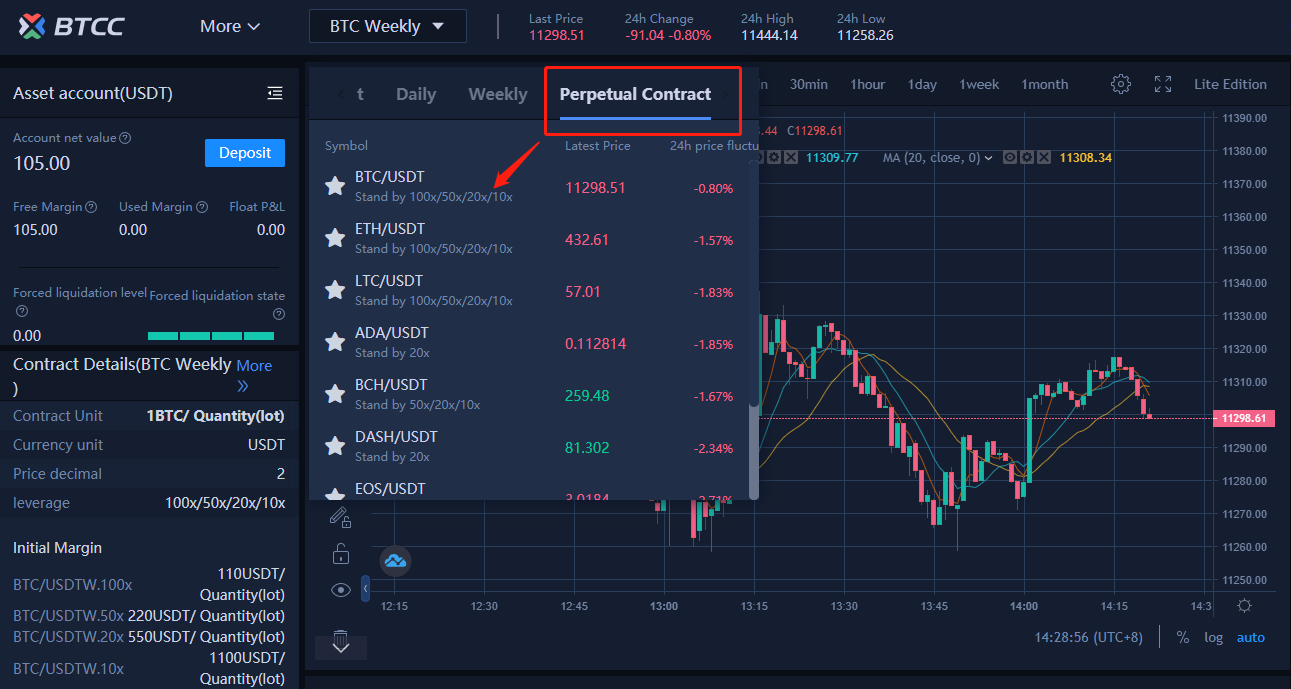

The margin that investors can harness when trading CFDs is generally stated as a fixed percentage. Trading CFDs carries a high level of risk since leverage can work both to your advantage and disadvantage. With forex trading, the eight major currencies make up the majority of the trading volume on the forex market.

Established five years ago, LiberalFX has quickly grown into one of the largest forex and CFD brokers.

With forex trading, the eight major currencies make up the majority of the trading volume on the forex market.

CFD trading has low barriers for entry in terms of cost and they are available to trade online. As a CFD trader, you can trade CFDs on shares, commodities, indices, options, ETFs and also forex. One of the core differences, and indeed the main advantage of trading forex through CFDs rather than through a traditional forex platform is a single, unified currency.