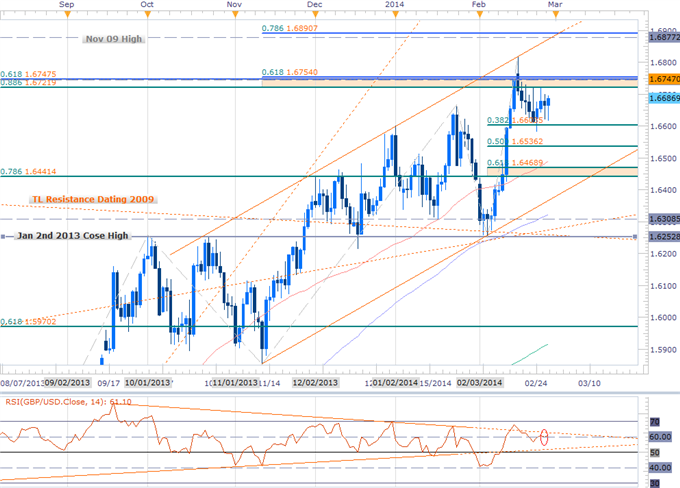

Forex Gains Ato. The ATO refers to this report as myTax and it is required by law to be filed with your annual income tax return. Keep in mind that it must be calculated when a forex realisation event happens, though.

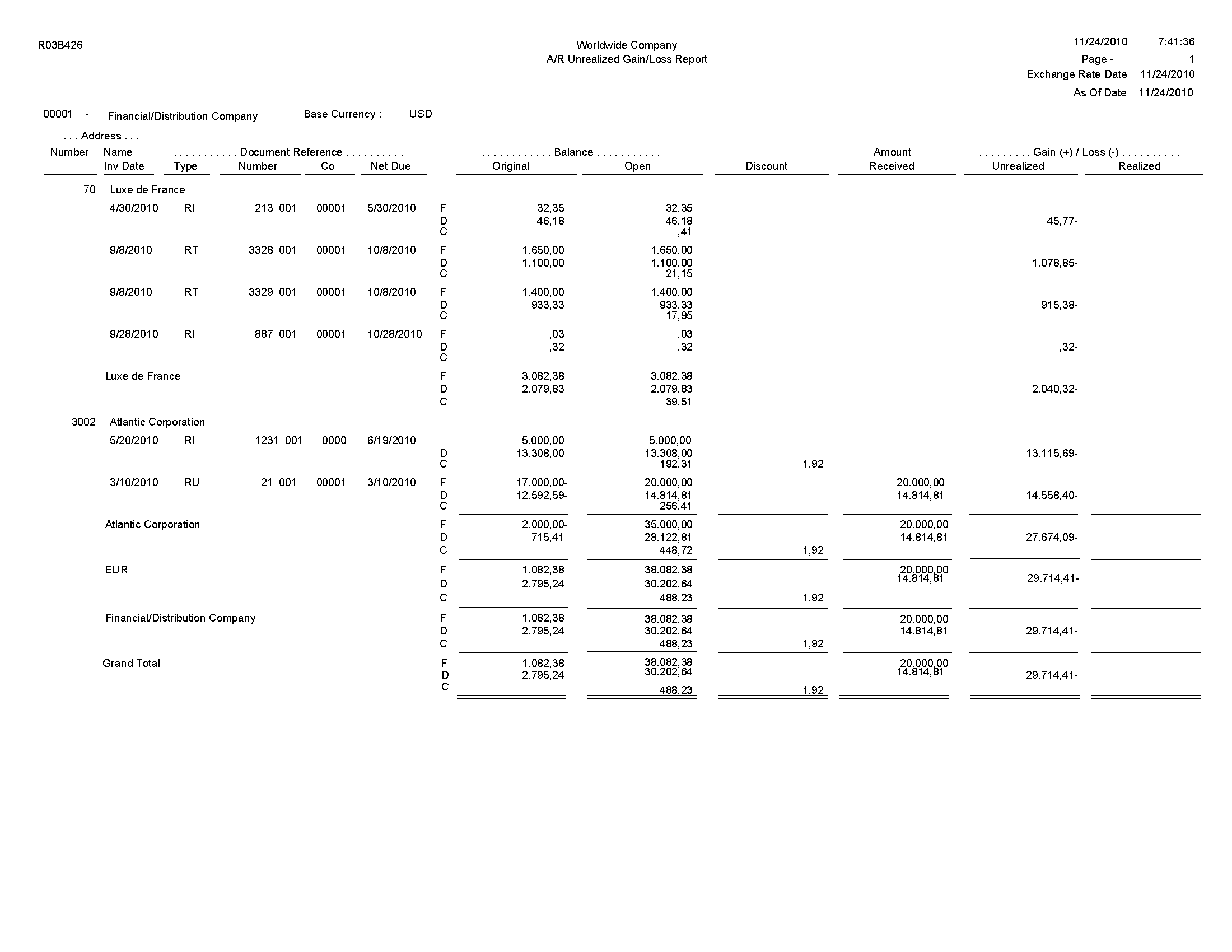

The forex realisation gain or loss represents the gain or loss in Australian dollar terms made in respect of the obligation owed to the banker, measured between the time that obligation was incurred (which was the time the funds were received) and the time that obligation ceases (which is at the time of deposit). Forex gains are assessable income, and losses are allowable deductions. Under the general translation rule, all tax-relevant amounts that are denominated in a foreign currency must be translated into Australian currency (unless falling within certain limited exceptions).

Long term holding investments definately are.

In Australia, capital gains are taxed at the same rate as the marginal income tax rate.

The forex market fluctuates on a daily basis, so you will need to know when these fluctuations will occur in order to calculate the tax due on your foreign currency gains. Keep in mind that it must be calculated

when a forex realisation event happens, though. This enables all gains and losses to be calculated using a common unit of measurement – the Australian dollar. a value.