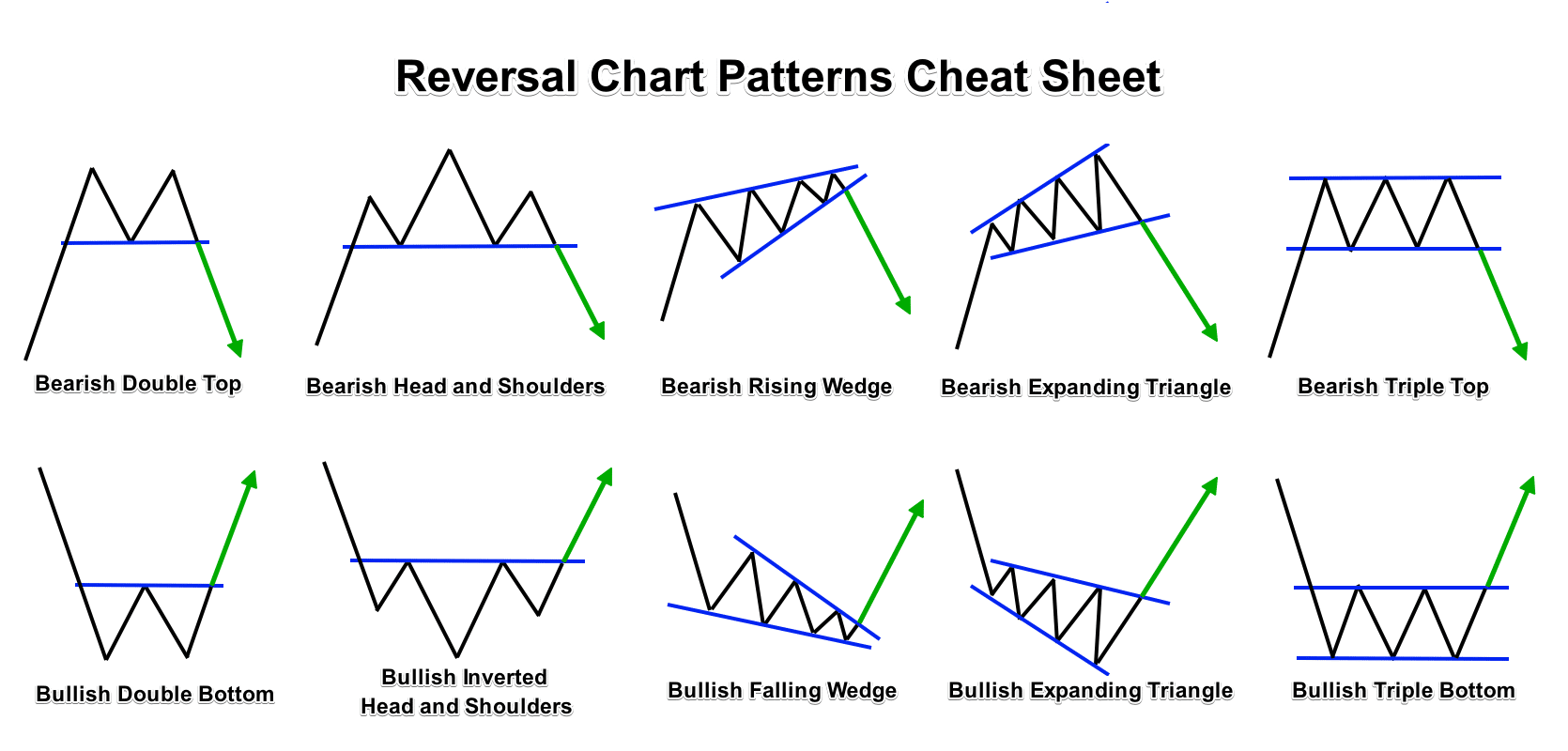

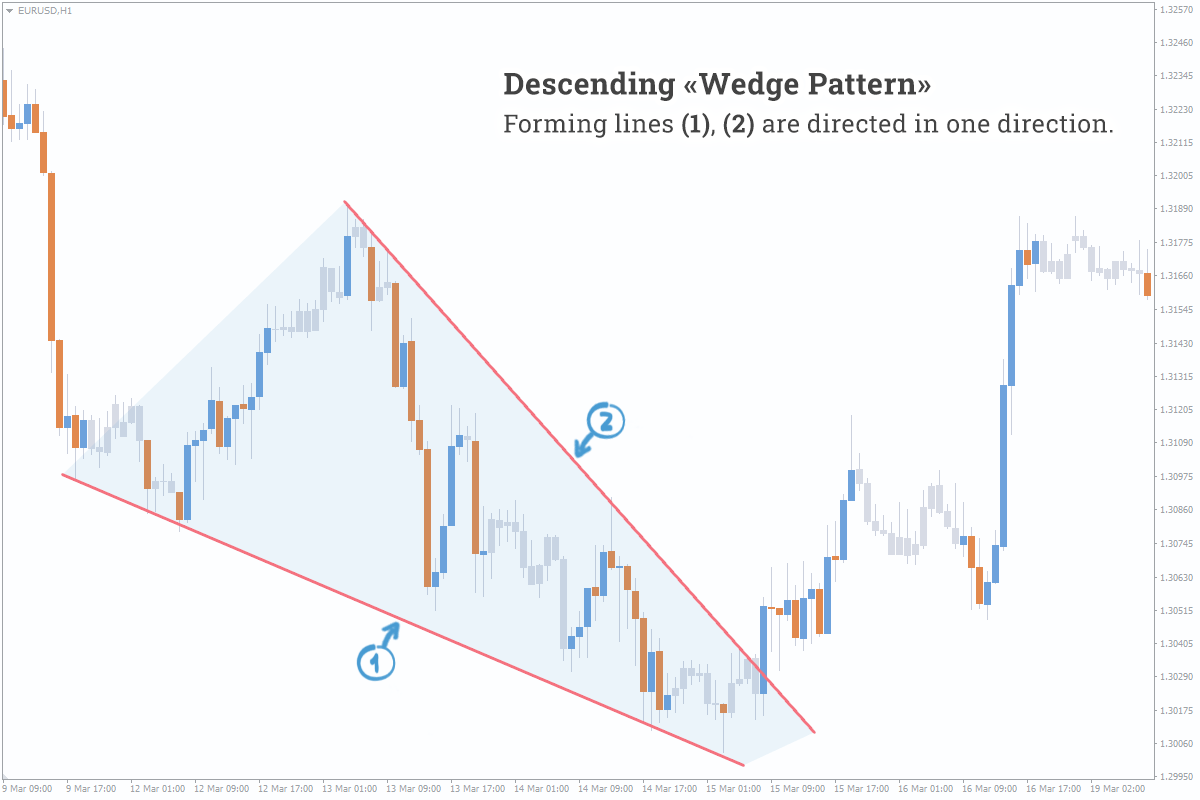

Forex Wedge Patterns. When you encounter this formation, it signals that forex traders are still deciding where to take the pair next. It consists of only two converging trend lines, which can occur as a falling (bullish) or rising (bearish) wedges.

A rising wedge is often seen as a topping pattern while a falling wedge is more often than not a bottoming pattern The wedge must have three touches on each side in order to be considered tradable The time frame used depends on the time frame that is respecting both levels the best A falling wedge forms when the market consolidates between two downward support and resistance lines. When you encounter this formation, it signals that forex traders are still deciding where to take the pair next. The wedge pattern has three common characteristics: Converging trend lines.

Symmetrical triangles have a downtrend line and an uptrend line.

Wedges are chart patterns that sign a continuation in the market trend formed before the wedge.

Wedge patterns are similar to triangle patterns in that they are marked by narrowing price ranges and converging trend lines. If you've read any of our previous postings on ch

art patterns, you'll notice that they all have a bullish and bearish variant. The shape of such kind price action looks like wedge, so that's why this pattern is called like that.