Forex Reserves. Foreign exchange reserves are reserve assets held by a central bank in foreign currencies, used to back liabilities on their own issued currency as well as to influence monetary policy. Foreign Exchange reserves, commonly known as Forex reserves, refer to assets like foreign currencies, treasury bills, gold, etc., under the possession of a central bank or a monetary authority that looks after the balance payments and directs the foreign exchange rate of a currency.

The table has current values for Foreign Exchange Reserves, previous releases, historical highs and record lows, release frequency, reported unit and currency. Therefore, the economy of Saudi Arabia mostly depends on Natural resources. The United States dollar is the most commonly used currency for forex reserves.

Reserves are held in one or more reserve currencies, nowadays.

Saudi Arabia is the world's largest generators and exporters of oil.

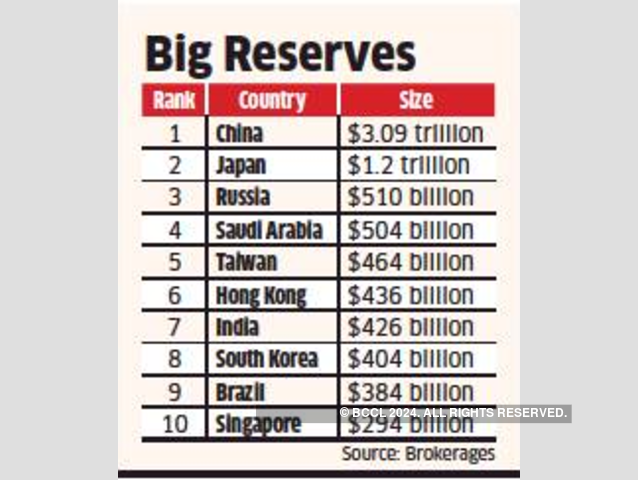

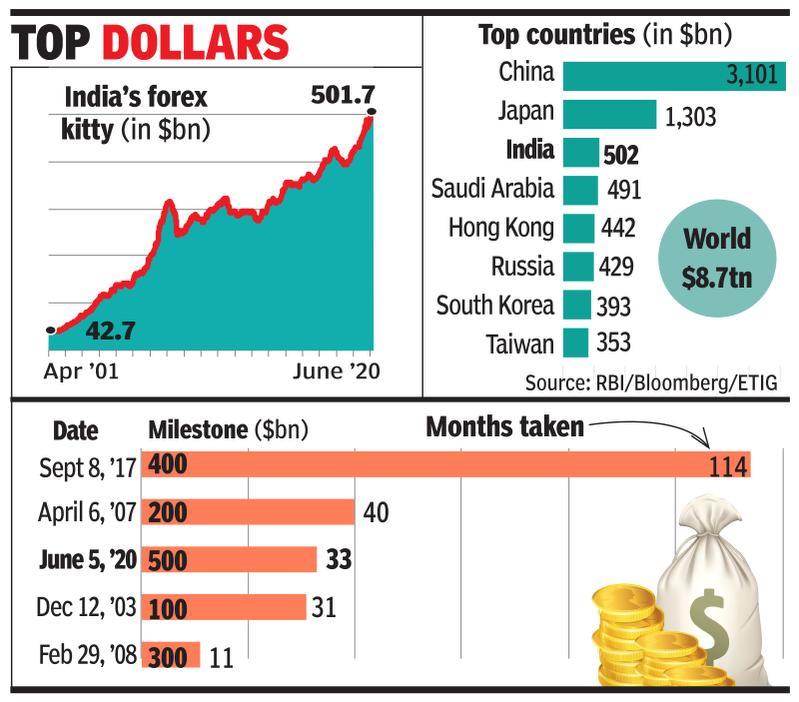

Note that the above table lists China's and Hong Kong's reserves separately. This page displays a table with actual values, consensus figures, forecasts, statistics and historical data charts for – Foreign Exchange Reserves. Foreign exchange reserves are r

eserve assets held by a central bank in foreign currencies, used to back liabilities on their own issued currency as well as to influence monetary policy.

/GettyImages-480922636-b14be4a73a594bad8f75adf132a77818.jpg)

_6_0.png)