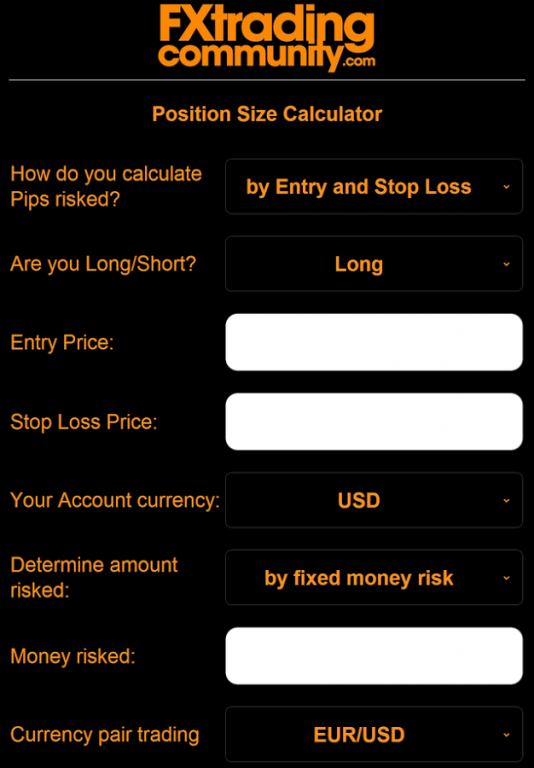

Forex Position Size Calculator. The Position Size Calculator helps you calculate stop loss, take profit and risk in terms of pip, percentage, price and money and other information that is essentail to open a position in your account currency based on your leverage, account type, trade size, trade direction and open price so that the probability of winning a trade will increase. Our position sizing calculator will suggest position sizes based on the information you provide.

The Position Size Calculator helps you calculate stop loss, take profit and risk in terms of pip, percentage, price and money and other information that is essentail to open a position in your account currency based on your leverage, account type, trade size, trade direction and open price so that the probability of winning a trade will increase. To easily calculate position size a forex trader should simply decide how many pips to risk based on what price they intend to place a stop loss order, together with how much money or percent account equity they wish to risk on the trade. Then a trader can simply enter these numbers into a.

S., this will likely be USD, whereas if you reside in the UK, you would choose GBP.

This is a free Forex tool provided by Asia Forex Mentor that allows you to calculate the correct lot size and units needed to manage your risk accurately.

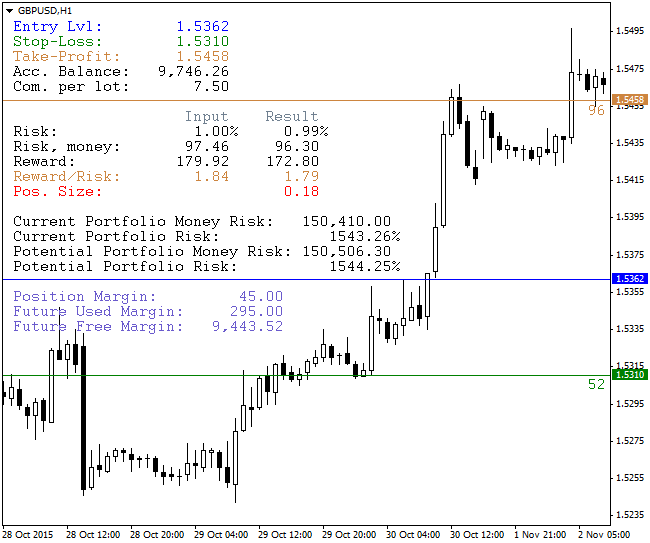

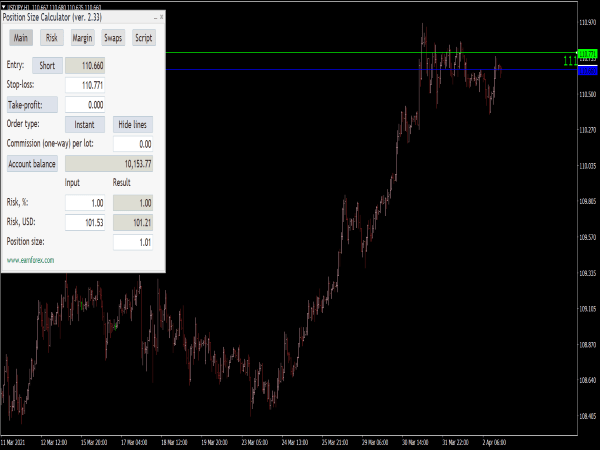

To easily calculate position size a forex trader should simply decide how many pips to risk based on what price they intend to place a stop loss order, together with how much money or percent account equity they wish to risk on the trade. The ideal position size can be calculated using the following formula: Account Risk / (Trade Pips x Pip Value) = Position Size in Lots. It works with majority of the currency pairs and all you need to do is to fill the.