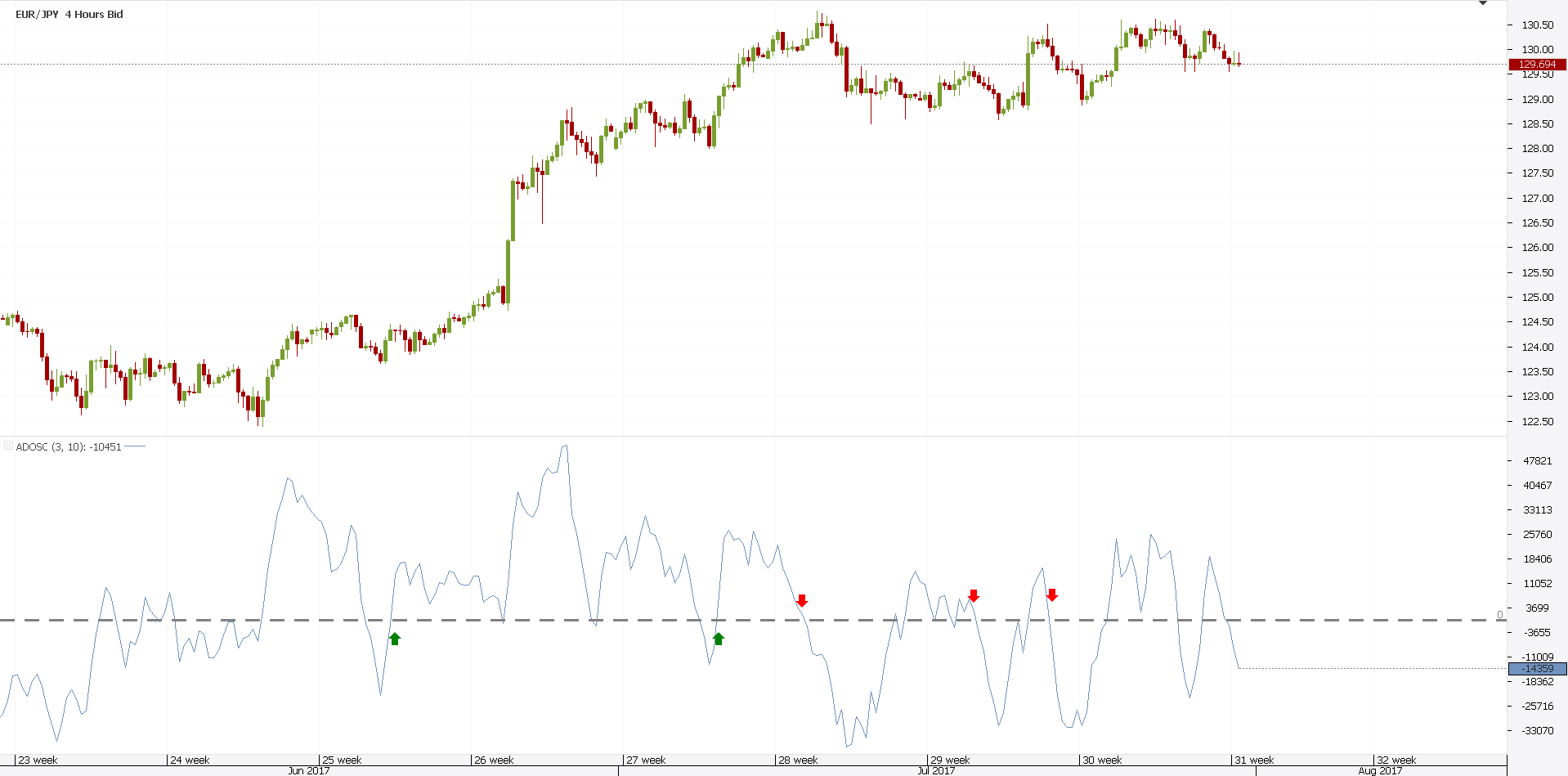

Forex Order Volume. In summary, the Forex Volume Indicator is one of the most useful tools in the trader's armament and you should always be assessing the strength of a move or a break, based on the volume that is being done around that price level. Volumen and order flow which is provided by Forex Brokers is useless because it is depending on the liquidity provider.

For overall highest volumes, look for the row colored mostly with green cells. But it can also be used to identify times to trade to ensure best execution. It's a microscopic look into candlestick studies.

Volume trading is one of the best strategies in forex because the quantity of an instrument moved in a given time reflects the buying and selling pressures in the market.

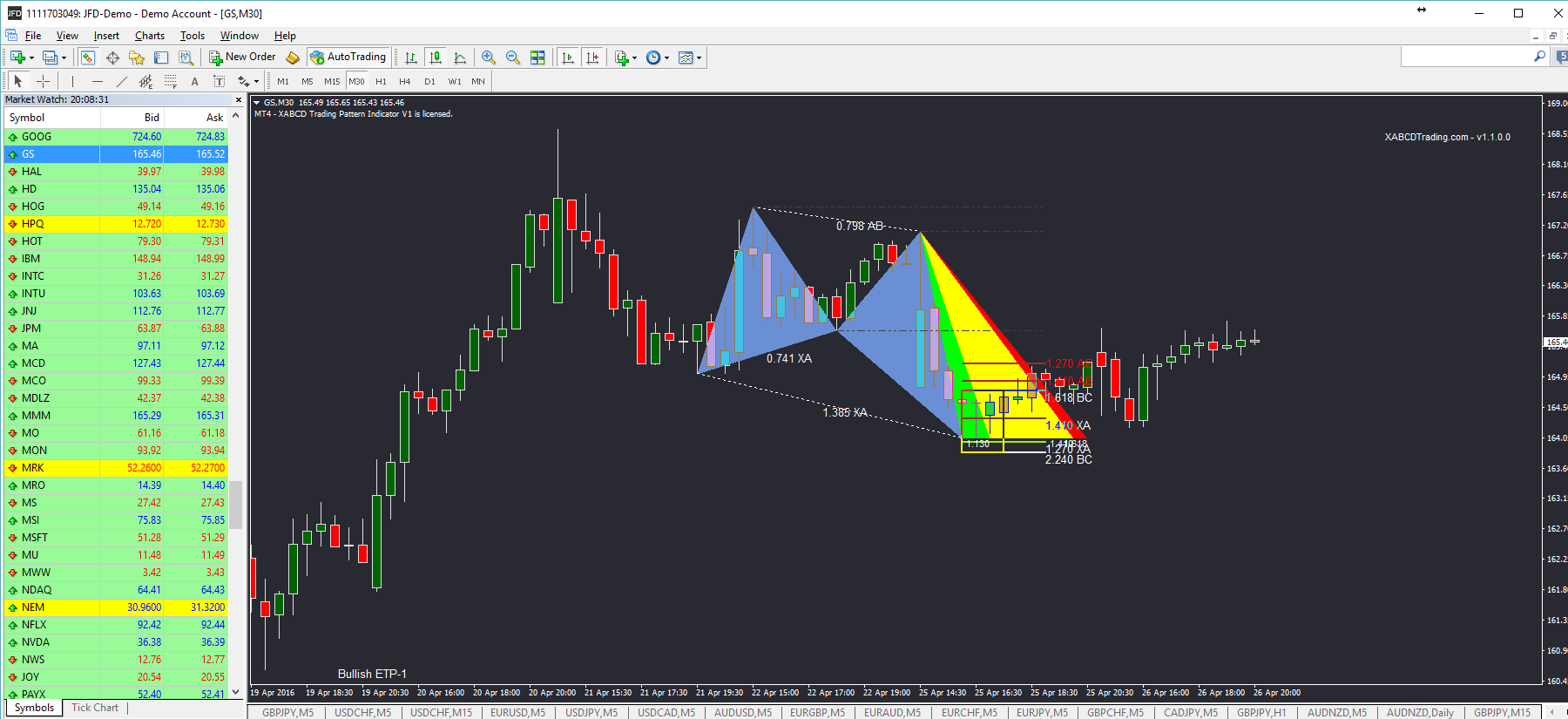

All of these, Volume, Supply and Demand, Order Flow – it's all the same, if you think you know one of them you should know all of them.

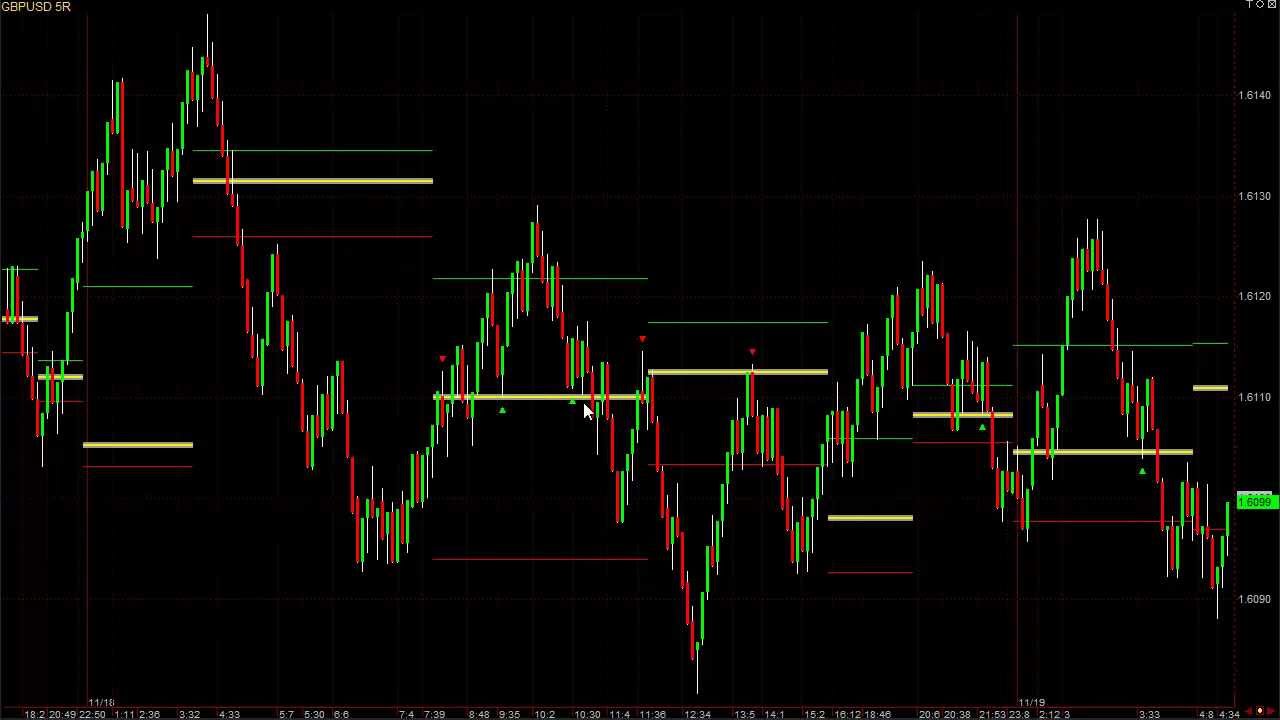

In the next sections, we will show you how to do it. Therefore, in forex, you would have to analyze and figure out where the awaiting order flow is by analyzing the char

t patterns. Order flow analysis helps you recognize the final details of the buying and selling volume.