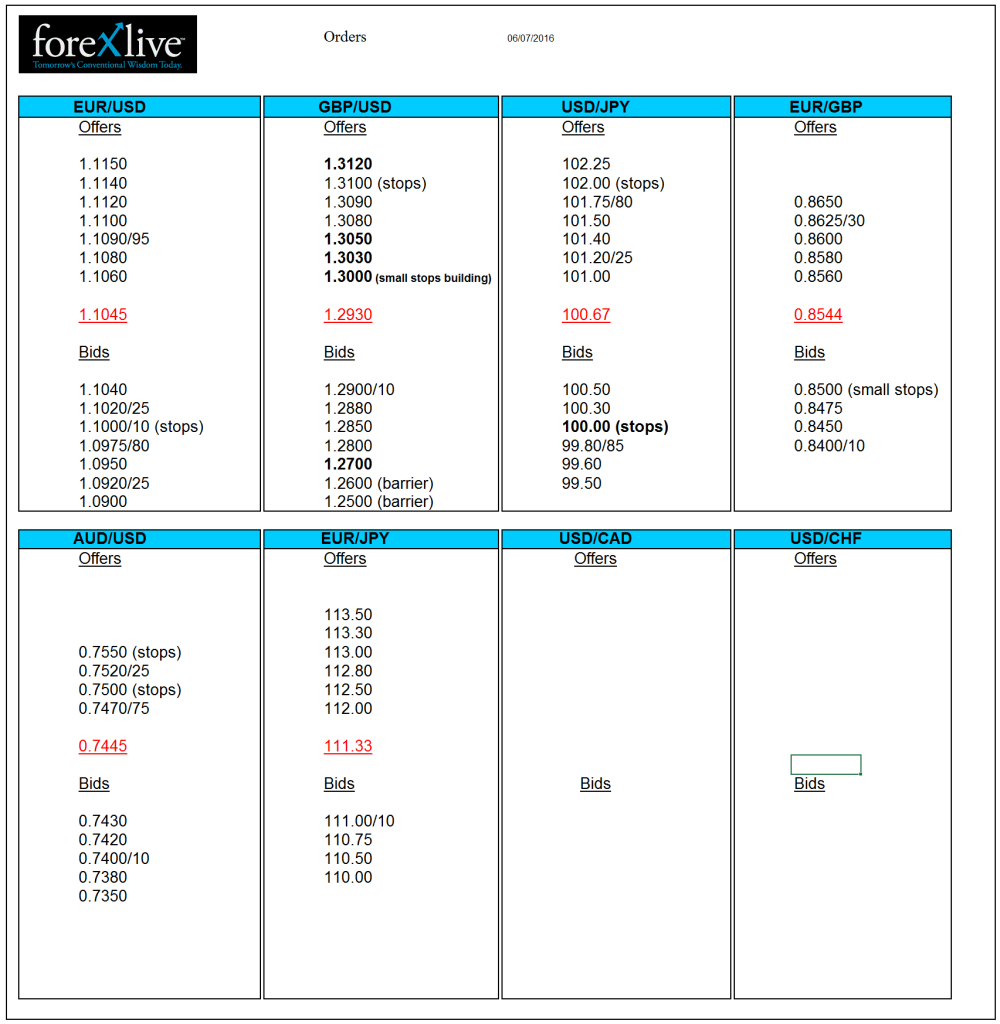

Forex Orders. Learning what they all mean can go a long way toward successful trading. Basically, the term "order" refers to how you will enter or exit a trade.

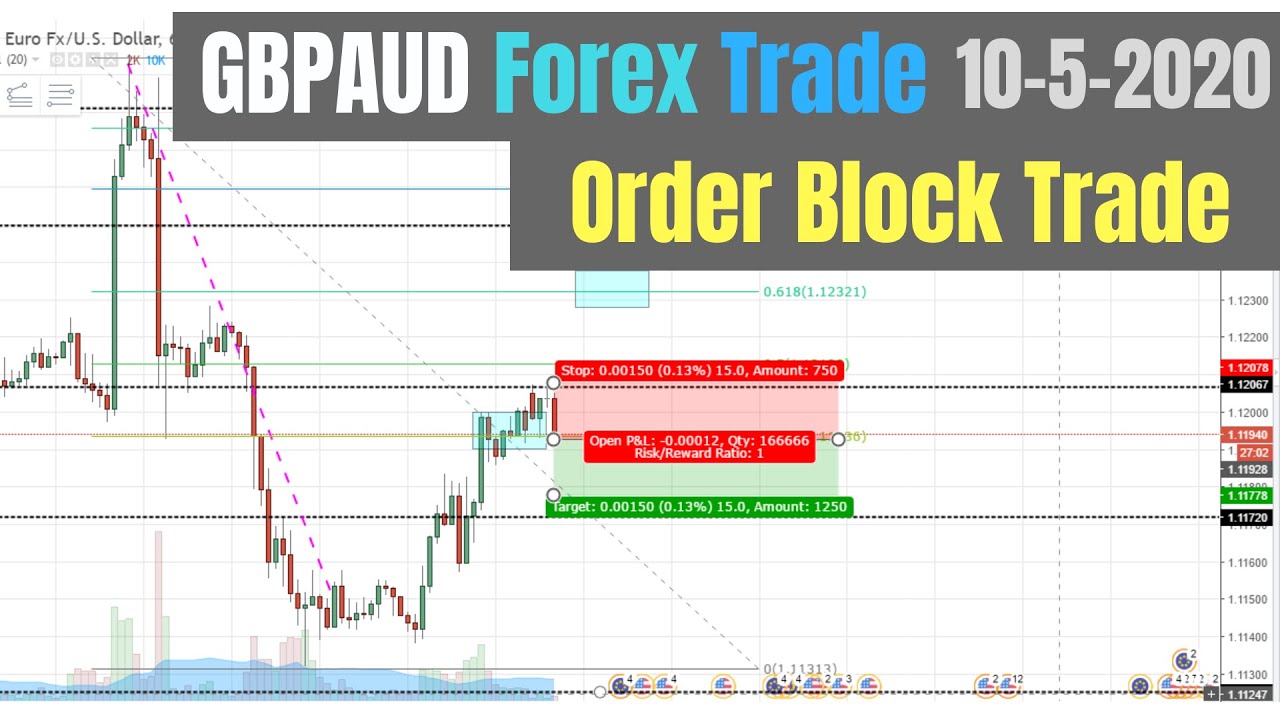

Identify your entry, stop loss, and profit levels I won't go into the "whys" of a trade since everyone has their own methods for determining directional bias, time, and volatility expectations. This type of order is usually placed with the expectation that the price will rise after a certain level of decline. Limit orders to open a trade The first is a limit entry order to get a better entry price.

They generate price action through their orders that are significantly larger than standard ones.

Identify your entry, stop loss, and profit levels I won't go into the "whys" of a trade since everyone has their own methods for determining directional bias, time, and volatility expectations.

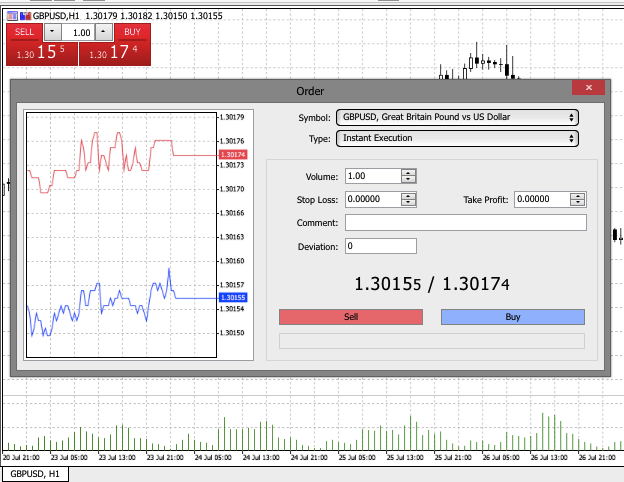

All forex orders come under two main types: Market Order This creates the forex order block. This order type enables the forex trader to leave their positions open with a certain amount of security as they know that if the trade hits the specific conditions, it will trigger the order to be executed. In Forex, the term order refers to how you will instruct your brok

er to enter or exit a trade on your behalf.