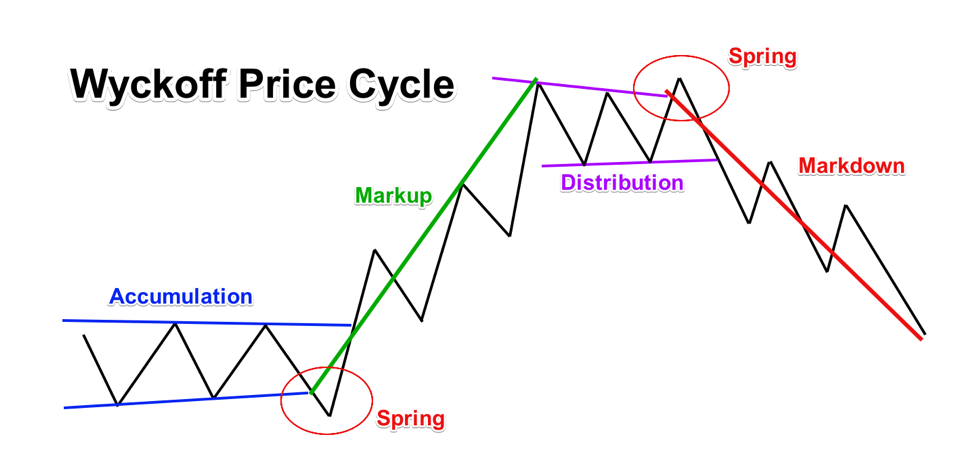

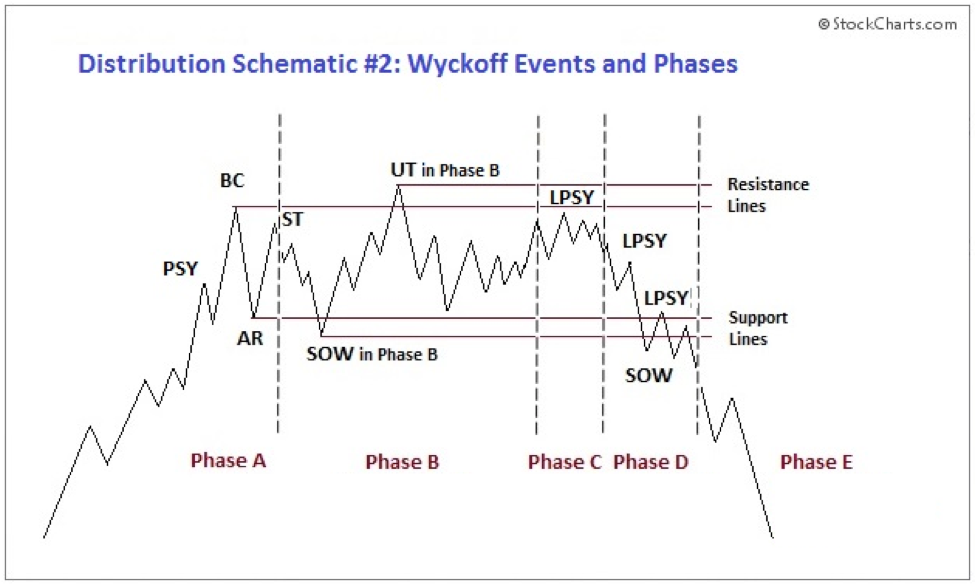

Forex Wyckoff Schematics. Wyckoff Schematics A successful Wyckoff analyst must be able to anticipate and correctly judge the direction and magnitude of the move out of a TR. A Wyckoff strategy can be broken down into a few simple steps.

Wyckoff Schematic Trading Ranges Distribution Accumulation Absorption What you are looking at here is a Schematic founded by the late Richard Wyckoff, a mogul to the history of technical analysis and stock trading or as most of us would refer to him as. the. "OG" of getting his paper up. The best strategy is to mark up orderblocks and then look for Wyckoff schematics on lower time frames inside HTF orderblocks. Now let's show the Wyckoff market analysis in action, using the trading strategy we discussed above.

Wyckoff method and Wyckoff Theory – one of the most trusted theories in trading.

These are the main smart money trade setups that you will find in your charts, this is how smart money (big banks, funds, composite man, etc.) manipulate markets to engineer liquidity.

This indicator is used to perceive the vertica

l bars in the forex market. A Wyckoff strategy can be broken down into a few simple steps. This video goes over the Wyckoff Schematic and how you can simplify it down using structure.