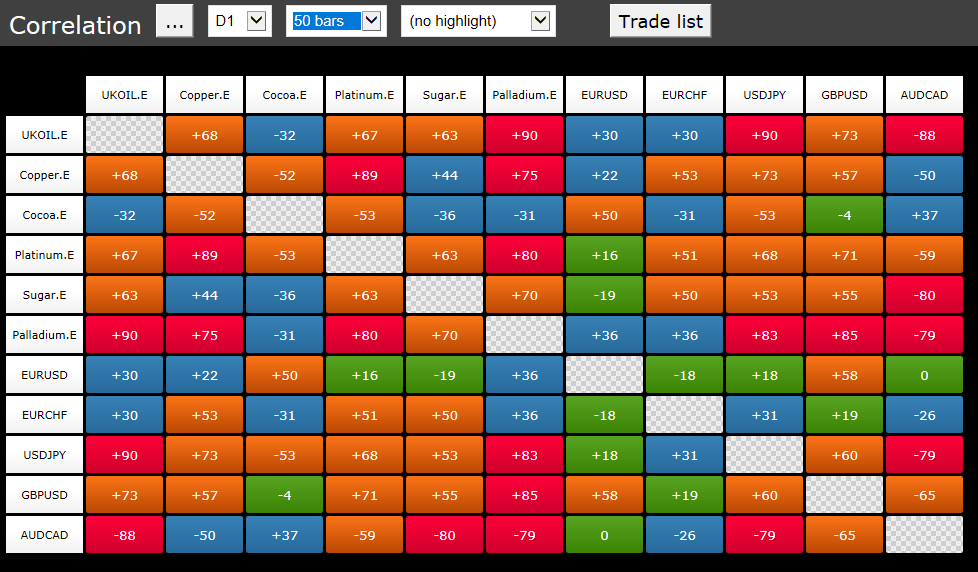

Which Forex Pairs Are Most Correlated. The image below is a perfect example. Effective traders typically take advantage of this negative correlation and hedge in one of the present pairs.

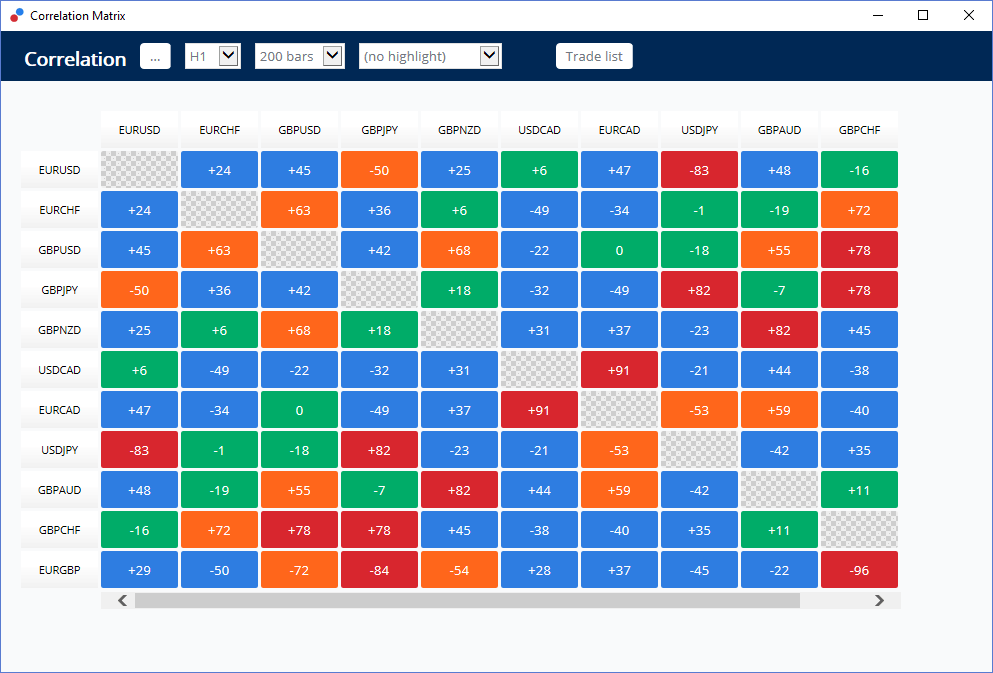

This situation is a severe problem and explains why EUR/NZD and GBP/NZD as the same pair only. The most correlated forex pairs tend to be those that not only share a currency, but also have close economic ties between the other currencies within the pair. We say these are positively correlated because they move in the same direction.

Effective traders typically take advantage of this negative correlation and hedge in one of the present pairs.

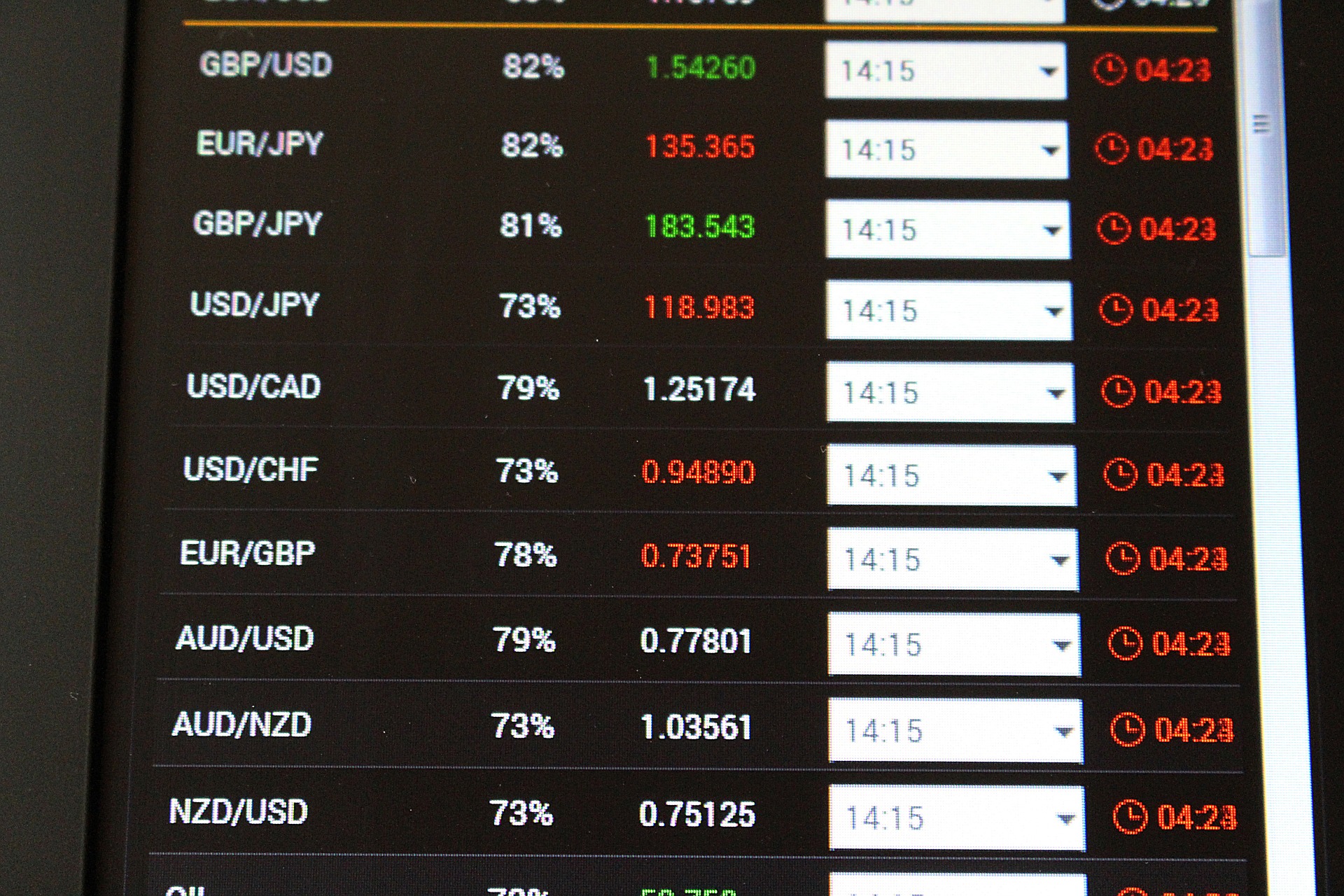

GBPUSD and EURUSD Highly correlated currency pairs in Forex Commodities that are correlated with currencies The Canadian dollar and crude oil have a positive correlation because Canada is a significant oil producer and exporter.

British Pound Sterling (GBP) is the currency pair of the United Kingdom and it is used all through England, Scotland, and Wales. The image below is a perfect example. Forex correlation represents the positive or negative relationship between two separate currency pairs.

.png)